Effective Operational Due Diligence is essential to make the right deal decision and ensure a successful post-merger integration

By Chris Tatham, Associate Partner, Global PMI Partners UK

Introduction

Mergers and acquisitions (M&A) may happen for a variety of reasons, and most will make the company stronger in product and market terms – assuming they are successful. Due diligence (DD) is a detailed investigation and appraisal of the current and historic condition of the target business or company being acquired. As Benjamin Disraeli famously remarked:

“Diligence is the mother of good fortune”

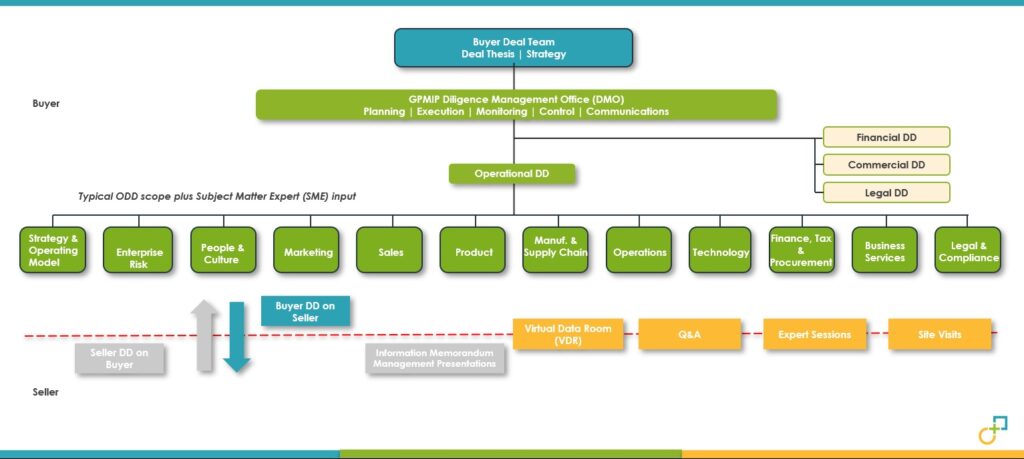

Key DD elements include Legal, Financial, Commercial, and Operational – see Figure 1. The information obtained during this process will assist the buyer in:

- Understanding what it is acquiring. It should seek to understand the company’s legal structure and competitive position, whilst evaluating the company’s internal capabilities and culture.

- Understanding the key end-to-end business processes, systems landscape, key 3rd party suppliers and, crucially, the dependencies on key people and pockets of institutional knowledge within the target company.

- Identifying any risks or liabilities which may affect how the deal is structured, or for which the buyer may require protection through warranties and indemnities.

- Ensuring the right price is being offered for the target business or company.

- Ultimately making the decision to proceed with the purchase.

In addition, DD should be seen as an opportunity to lay the foundation of the future, post-deal integration and value creation.

Whilst many acquisitions conduct Commercial and Financial due diligence, a comprehensive Operational Due Diligence (ODD) is often conducted poorly or not at all, leading to unforeseen issues that can derail the deal or result in a significant reduction in shareholder value post close. The focus of this paper therefore is successful ODD which will be further examined through the four phases: Plan and Kick Off, Data Gathering, Diligence Analysis, and the Final Report.

Figure 1

Elements of Due Diligence Scope and Process

- Plan and Kick Off

With multiple stakeholders, advisors, and a significant amount of data to review then a disciplined approach to DD is essential. Timescales will vary from months in some cases, although urgent deals could be only a matter of weeks. It is important to build momentum fast and then maintain a healthy tempo and cadence.

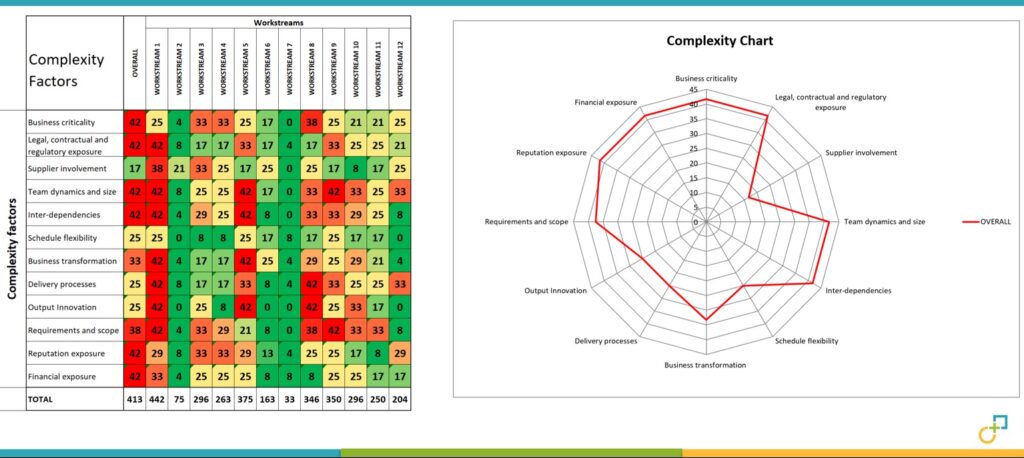

Establishing a Diligence Management Office (DMO) as part of the governance model is recommended, which will provide planning, execution, monitoring, control, and communications functions. The first tool to establish is the diligence team database to manage the stakeholders, a RACI model is preferred to determine who is responsible, accountable, consulted, and informed. This can also be used to manage insider lists to maintain deal confidentiality, and which are mandatory for public deals (i.e. involving listed companies), where the identity, the reason they are on the list, and date recorded are required. The DMO function can be run in house, in which case a playbook approach can help significantly, but a specialist firm like GPMIP will quickly confirm the planning assumptions, have the project management tools, including health checks and programme complexity assessments (an example of GPMIP’s complexity tool is shown in Figure 2), and develop the key communication messages.

Figure 2

Complexity Management

The DMO should coordinate all advisors on behalf of the client deal team, including those conducting legal and financial DD, which are usually conducted by professional advisory firms. The scope of the ODD will also be determined, including the use of subject matter experts (SME’s). During this initial period, it is critical to both ensure alignment around the high-level view of the likely combined business vision, strategy and target operating model (integration ‘deal rationale’ & ‘blueprint’ respectively) and identify any transaction specific elements such as regulatory or competition requirements.

It is also important for the acquirer to understanding the motives of the seller. These could include that it is a good time to sell, and they believe they can do so at a premium, competition has become too high, the product cycle dictates significant investment is required, the owner wants to retire, or shareholders want to liquidate.

The DD process should extend to broader issues of culture, systems, structure, business plans, and functional strategies to enable the buyer to have as full a picture as possible of the value creating potential of the target. It needs to also cover issues such as sustainability and environmental performance; both areas are potential sources of significant risk. The 2022 GPMIP Annual M&A Success Survey also highlighted that digital transformation diligence will become increasingly important. DD should be seen as the opportunity to begin the process of post-deal integration.

Seller DD

Due diligence is not usually a one-way street, in addition to Buyer DD, the Seller will conduct elements of DD both formal and informal on the Buyer which could include:

- Determining the potential Buyer is financially viable and understanding the deal funding.

- Assessing the culture and management of the buyer, as they want to provide continuity and a safe home for their existing management team who may be retained in the business.

- Understanding the Strategy and Combined Business Plan and therefore the potential and risks around achieving any earn-out requirements.

These serve to provide comfort to both the buyer and the seller.

- Data Gathering

A motivated seller will typically provide an information memorandum and management presentations to aid the DD process. In some cases, independent or expert reports may be provided by the seller as part of marketing the transaction. In conducting such diligence, information may become apparent which impacts the valuation.

Data is normally held in secure repository, which could be as simple as a SharePoint site, but more normally sellers choose to use a virtual data room (VDR) for which there are many providers, and some professional firms have “in-house” solutions.

It is not unusual on a large transaction for there to be 600-plus items in a VDR, potentially running to 10,000 or more pages, so a disciplined and structured process is required with clear responsibilities and a method for recording and reporting key findings.

No matter the volume and quality of the content in a VDR, the trick in the next step for Diligence Analysis is for the DD team to quickly ascertain the most important facts and assess what additional information needs to be collated, assessed and discussed.

- Diligence Analysis

The diligence analysis phase will then commence and there are a few important considerations required around resourcing and phasing. Resources within the buyer often need to stay focused on running business as usual and may not have the bandwidth or expertise to conduct extensive data analysis and therefore specialist teams, such as GPMIP, who have both industry/sector expertise and functional experience, can be engaged to support ODD.

There is a masterful quote from Donald Rumsfeld, Former United States Secretary of Defence: “There are known knowns, things we know that we know; and there are known unknowns, things that we know we don’t know. But there are also unknown unknowns, things we do not know we don’t know.”

The advantage of an experienced practitioner SME DD team is that they can rapidly assess the known unknowns and even elements that for the buyer which could be unknown unknowns can also be identified and assessed. During this period there will be a number of questions and answers (Q&A) required as the SME’s drill down into the data. Good VDR tools will record and facilitate the Q&A process, or a DD tracker tool can be used. This can be a time consuming and intensive process as the Seller spends time and resources compiling information, ultimately the efficiency of managing this process can impact the deal timetable.

During this phase, additional requirements for DD may be identified, an example is described below:

Juliet Baker, Senior Director, GPMIP UK, HR, People & Culture SME, noted:

“In a recent timebound DD exercise involving the potential carve-out by a PE backed private company of a significant division of a listed healthcare and distribution company, it became clear that the benefits diligence was raising a number of concerns around pensions, life assurance, share schemes, and long-term incentive plans (LTIP). As the buyer had limited HR resources, GPMIP were able to deploy a specialist benefits expert within 24 hours to provide a clear assessment, to explain to the buyer how this impacted the valuation and required an update to the terms of the SPA and TSA, and to put a plan in place to manage through the Day 1 target communication and provide non-listed benefits solutions for the integration plan.”

An experienced DD Team will not limit themselves to only VDR review, expert sessions should be arranged to interview the seller’s management, demonstrations will be required of systems, products, or capabilities, and site visits are the best way to gauge a business, it’s people and culture. The cultural aspects should not be underestimated, it is imperative to develop an understanding of the buyer and target corporate cultures, to engage ‘hearts and minds’, and to consider how the cultures will come together.

During this phase, the business case will usually be subject to a high-level review of revenue, cost, and synergy models to be further validated by appropriate workstreams; this will usually be conducted in close coordination with the financial DD advisors.

- ODD Final Report

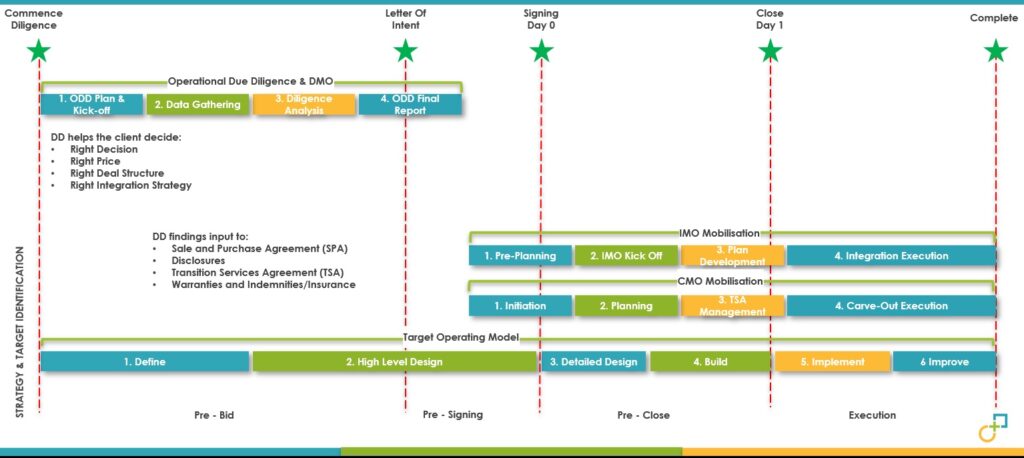

It is important to start with the end in mind so the output can feed into both the deal documentation and the next phase post signing (see Figure 3). The buyer’s deal team and steering committee will require interim updates so the report should be formatted, and information collated in such a way to facilitate this.

Figure 3

Due Diligence – begin with the end in mind…

| Effectively planned and executed due diligence is a vital component for a successful transaction integration and is the first and most important step in delivering both the tangible and intangible deal benefits and maximising stakeholder value. |

Typically, functional diligence templates will be completed, including key insights pages and executive summaries. Findings are normally risk assessed based on materiality and it is common to classify on a flag-based approach. A red flag refers to some warning signal that points to a potential threat, real or perceived, and which warrants further investigation and could be considered a deal breaker. An amber flag will typically highlight a concern that can be managed or mitigated, and a green flag is a clean bill of health, or sometimes an opportunity. Further classification of red flags for example by business continuity, optimisation or cost will help stakeholders understand the significance. It is important to be clear on what is essential to get a deal across the line and what can be addressed later.

An example from a recent DD exercise illustrates this below:

Jonathan Wogel, Senior Director, GPMIP UK, Industry SME, noted:

“Far East supplier contracts, quality, and regulatory assurance (QA RA), and medical device registrations for exporting to the EU were specialist areas for a recent DD engagement which had the potential to be deal breakers. Through detailed contractual and financial DD review in the VDR, management interviews, confirming registrations requirements through professional contacts, and 30 years industry experience we were able to assure the client that while there were no red flags, a mitigation and action plan could be developed in the integration planning phase to mitigate the risks for the amber items. We could also support the underwriter’s detailed questions while establishing the warranties and indemnities insurance. The deal was duly signed allowing the client to establish a significant foothold in the UK market.”

As the DD continues the findings will start to feed into the deal documentation including the sale and purchase agreement (SPA), disclosures, transition services agreement (TSA), where applicable, and warranties and indemnities/insurance.

The findings will feed the pre-planning and initiation for the integration or carve out phase and contribute information into the target operating model.

Prior to signing VDR’s are often closed with the contents then only available on a memory stick. The buyer and advisors should download the content of the VDR, within the conditions permitted in the terms, to ensure the data is seamlessly accessible to support integration plans. It should be noted that in some deals, this data may then become subject to competition compliance restrictions during the Sign to Close period, which is essential for the integration planning team to manage, leading to successful Day 1 preparation and a fast start to integration and synergy execution from Day 1.

Conclusion

When you are engaged in M&A activity, effective DD will enable you to assess the competitive environment, internal capabilities, and risks to ensure you can make the right decision at the right price. If successful, then quality DD will seamlessly feed into the post deal integration or carve out phases.

GPMIP is available to partner flexibly with you, to support your DD, with industry leading IP, and practitioner sector, functional and project resources to ensure the right conclusions are drawn, decisions made, and so diligence can deliver “good fortune”.

Chris Tatham is an Associate Partner in Global PMI Partners UK. Following six years’ service in the British Army, he has over twenty years’ experience in the Financial Services industry as a COO and Management Consultant with extensive knowledge of the Middle East. He has recent start-up experience as Chief Corporate Development Officer in a leading Healthtech company. He has experienced M&A and Post Merger Integration from all perspectives and is a strong advocate of deploying the right skills, tools and practitioner experience in a bespoke manner to deliver success.

Global PMI Partners is a specialist consulting firm supporting our listed company and private equity clients with their growth strategies, M&A integrations and divestments, and transformation initiatives. We provide expert, on-demand M&A and transformation services and resources, leveraging our market leading approach & methodology.

With a track record of over 500 operational due diligence, acquisition integration, divestment, carve out and growth projects utilising our UK team of 160 seasoned professionals (400+ globally, across EMEA, North America and APAC), we are adept at helping our clients achieve the desired value from acquisition, divestment, and transformation strategies.