Maximizing Value in Mergers: Crafting a Unified Path for Success

Michael Holm

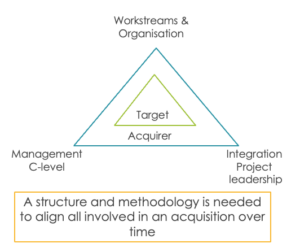

In the dynamic landscape of post-merger integration, a critical challenge is harmonizing stakeholders across acquiring and target companies. This encompasses C-level executives, middle management, employees, functional teams, and the integration project itself. The key to achieving seamless integration lies in the establishment of a robust structure and methodology.

Key Areas of Focus in Post-Merger Integration:

- Integration Governance and Project Setup:

- Define the governance structure and set up the integration project for success.

- Communication During Year 1:

- Establish effective communication channels to bridge the gap between stakeholders during the crucial first year.

- Strategy Alignment and Execution:

- Ensure alignment between the overarching strategy and its execution within the integrated entities.

- PMI Objectives & Synergy Implementation:

- Clearly outline post-merger integration objectives and execute strategies to realize synergies.

- Alignment on Key Integration Action Items:

- Foster alignment among all parties involved on critical integration action items.

- Agreement on End-State Operating Model:

- Define and secure agreement on the ultimate operating model post-integration.

Structural Alignment Among Six Key Stakeholder Groups:

(See the accompanying diagram for a visual representation.)

Supporting Methodology for Seamless Integration:

- Logical Way-of-Working:

- Establish a logical progression from deal rationale down to individual tasks.

- Common Terminology:

- Implement consistent terminology across all facets of post-merger integration.

- Understanding the Integration Journey:

- Provide a comprehensive understanding of the integration journey over the course of 1-2 years.

- End-to-End Holistic Approach:

- Foster a holistic approach spanning from customer lead to delivery for a unified organizational perspective.

- Feedback Loops for Adaptation:

- Incorporate feedback loops to dynamically adjust to evolving circumstances on the ground.

- Agility in Response to Market Changes:

- Cultivate agility to adapt seamlessly to shifts in market dynamics and the business environment.

- Choosing Management Approach:

- Provide flexibility in adopting either a management-by-objectives or a task-oriented approach based on organizational needs.

Collaborative Framework:

Success in post-merger integration is achieved when acquiring and target companies collaboratively establish the structure and methodology immediately after signing. This joint effort ensures a unified approach, setting the stage for a successful integration journey.

Michael Holm has been a Partner for 13 years at Global PMI Partners covering Nordics, Baltics, Poland and DACH, a specialist consulting firm supporting our listed company and private equity clients with their inorganic growth strategies and M&A integrations and divestments around the world. We provide expert, on-demand M&A services and resources, leveraging our market leading M&A approach & methodology.

With a track record of over 500 operational due diligence, acquisition integration, divestment, carve out and growth projects Global PMI Partners is with 350+ consultants primarily in Europe and US adept at helping our clients achieve the desired value from both acquisition and divestment strategies.