Driving Value Creation through Operational Transformation in Private Equity

By Chris Charlton, UK Managing Partner

Operational transformation is a strategic approach that involves making significant changes to a company’s core business processes, technology, and culture to enhance its overall efficiency, productivity, and profitability. When applied to private equity portfolio companies, operational transformation can be a powerful tool to create substantial value. Here are some key factors and strategies for achieving successful operational transformation in private equity portfolio companies:

1. Thorough Due Diligence:

Conduct a comprehensive operational due diligence before acquiring a portfolio company. Understand the company’s current operational landscape, identify pain points, and assess potential areas for improvement.

2. Clear Strategic Objectives:

Define clear and realistic strategic objectives for the transformation. Align these objectives with the overall investment thesis and value creation plan for the portfolio company.

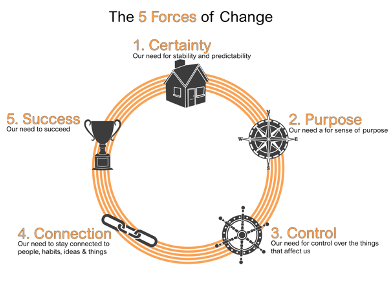

Figure 1: Key Transformation Success Factors

3. Experienced Leadership:

Appoint experienced and capable leadership with a track record of successful operational transformations. This includes executives who understand the industry, have change management expertise, and can drive the desired outcomes.

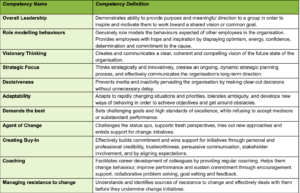

Figure 2: Core Change Leadership Competencies

4. Data-Driven Decision Making:

Utilise data analytics to gain insights into operational inefficiencies, customer behaviour, and market trends. Data-driven decision-making ensures that transformation efforts are targeted and effective.

5. Focus on Key Value Drivers:

Identify and prioritize key value drivers specific to the industry and business model of the portfolio company. Focus on areas that will have the most significant impact on operational efficiency and profitability.

Figure 3: Identify Value Drivers

6. Employee Engagement and Culture:

Foster a culture of continuous improvement and innovation. Engage employees in the transformation process, communicate the benefits, and provide training and support to ensure a smooth transition.

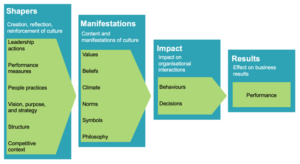

Figure 4: Culture & Its Impact on Performance

7. Streamlining Processes:

Streamline and optimise core business processes to reduce inefficiencies and enhance productivity. This may involve implementing new technologies, revising workflows, and eliminating redundant tasks.

Figure 5: Comprehensive Process Area Taxonomy

8. Technology Adoption:

Embrace technology to automate and digitise processes where applicable. This can improve operational efficiency, reduce costs, and enhance the overall competitiveness of the portfolio company.

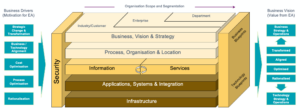

Figure 6: Create a Long-term Enterprise Architecture View

9. Supply Chain Optimisation:

Evaluate and optimise the supply chain to reduce lead times, lower costs, and enhance flexibility. This is especially relevant for companies involved in manufacturing or distribution.

Figure 7: Supply Chain Cost reduction Levers

10. Customer-Centric Approach:

Align operational improvements with customer needs and expectations. Enhancing customer satisfaction can lead to increased loyalty and revenue growth.

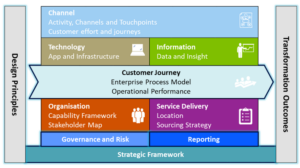

Figure 8: Customer-Centric Target Operating Model

11. Continuous Monitoring and Adjustment:

Implement robust monitoring and reporting mechanisms to track the progress of operational transformation initiatives. Regularly assess the outcomes, adjust strategies as needed, and ensure that the transformation aligns with evolving market conditions.

Figure 9: Transformation Building Blocks

12. Exit Planning:

Consider the exit strategy from the outset of the investment. Ensure that the operational improvements align with the long-term goals of the private equity firm and potential future buyers.

In conclusion, successful operational transformation requires a holistic and well-coordinated approach that addresses the unique challenges and opportunities of each portfolio company. By focusing on key value drivers, leveraging experienced leadership, and maintaining a commitment to continuous improvement, private equity firms can create significant value within their portfolio companies.

Chris Charlton is a Managing Partner and the UK CEO for Global PMI Partners, a specialist consulting firm supporting our listed company and private equity clients with their value creation strategies, including buy and build and operational transformation. We provide expert, on-demand M&A and transformation services and resources, leveraging our market leading M&A approach & methodology.

With a track record of over 500 operational due diligence, acquisition integration, divestment, carve out and operational transformation projects utilising our UK team of 180 seasoned professionals (400+ globally, across EMEA, North America and APAC), Global PMI Partners is adept at helping our clients achieve the desired value creation from both buy and build and operational transformation strategies.