Post-Merger Integration for Joint Ventures

By Mark Gallagher, Senior Director, UK, Global PMI Partners

You have done all the hard work, identified the target, spotted the value upside, modelled the economics and made the approach. The counterparty are receptive, they can see that there is unfulfilled potential and like your ideas for the future of the asset.

But they decide not to sell and propose a Joint Venture (JV) with you as a minority partner. Is the deal over or worth considering? Is there still value in the opportunity?

This is a dilemma which comes up quite often and often polarises into two extremes – it either kills the deal or the acquirer continues as if very little has changed. Neither approach is right – some things remain the same, but others are radically different and there are also brand new issues to be considered. Often these changes are either not explicitly surfaced, aren’t owned or are poorly integrated into the deal, increasing the chance of the deal collapsing or, worse, failing post deal, when strategy, reputation and value can all be damaged. Most deals are risky, but JV’s carry additional risk and “accidental” JVs even more so.

What changes and what doesn’t when a deal turns into a JV

The good news is that many things remain the same. From the acquirer’s point of view, the strategy and logic for the acquisition remain the same. The opportunity for value enhancement had been identified and the underpinning logics remains largely unchanged. Similarly, in terms of the deal, much of the Due Diligence, verifying what you are buying, and negotiation, what you need to pay for it, are the same. The deal teams on both sides usually remain the same, so not surprisingly they often continue with what they were doing before with only some minor changes to reflect the shared ownership.

What has however fundamentally changed is who will operate and hence deliver the future value promised in the deal. As a non-operating partner, you don’t have the flexibility to choose the people, and to decide the how, what and when things are done. There is also a bigger point here, which is often underappreciated, but has a profound impact in the deal. When you buy into a JV as a non-operating partner, you are not just buying the asset but an operating entity. Not only what it does and how it works needs to be understood, but also how it will be overseen, its scope to evolve and your rights to intervene all need to be incorporated into the deal. This will include being clear on any non-negotiables, what standards will be used, what support will be provided to the JV etc … the list goes on.

Delivering Business Value – and not just a successful deal completion

Like any post-merger integration, there are huge benefits in having a clear framework which builds on previous experience to set up for future value delivery. However, when you are not the operator, the default position tends to be to take a reactive stance based on information presented through the board meetings and other governance mechanisms.

In our view this is to set up for failure, or at least a suboptimal outcome, since the ambition, engagement and, above all, mindset should remain that of a direct operator. This gives a clarity on what you want from the business, which in turn can then be developed into tactics and behaviours that recognise the limitations of being a non-operator in a JV.

This may seem obvious but does not always happen. Too often, the minority partner becomes passive, disengaged, and ineffective in adjusting the trajectory of the business to meet their business goals.

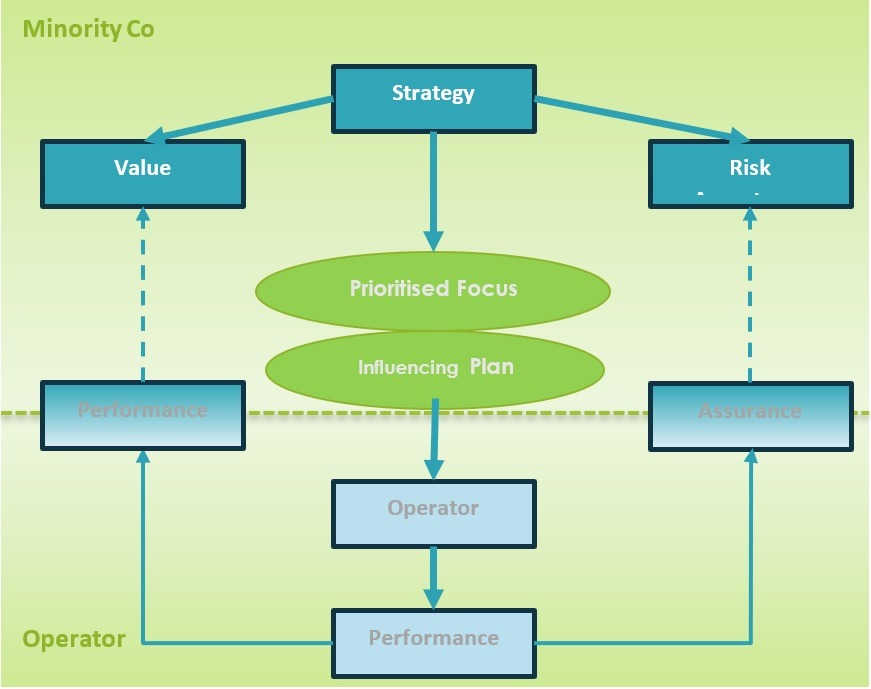

We use the following model to turn this intent into a framework for action. It is simple, but gives appropriate focus, sets objectives, and allows for accountability for key elements of managing the JV, including ensuring business visibility, identifying the priorities and exercising effective influence.

Visibility – What do you need to know to understand the business

Being proactive is no good if you are running blind, so getting direct access to a suitable level of data is important. Obviously, board reports and other information will be available, but does this cover critical aspects of the operation and in enough detail? If it raises questions, can further information be requested? Too often, the data supplied is broad, biased towards the operators view of priorities and presented to support an overall narrative.Is it also clear the type and level of risks in the business and are these mitigated. There will always be a risk profile, but is this generic or focused on your view of the key risks? There have been plenty of examples of JVs where the non-operator has been happy with the business performance but has a rude awakening when something goes wrong, and they realise the risks that were underpinning the returns.

Priorities – Where to place your powder

As with all M&A, knowing what to focus on and where to prioritise is essential to avoid confusion and diluted effort. When you are not the operator, then your scope for control is diminished and you are such more reliant on influence vs direct authority. The good news is that this influence can be hugely effective if it is focused on what really drives your strategy and impacts business performance. Focusing on these few priorities consolidates the efforts of the limited resources of the minority team and the consistent reinforcement of the same themes enhances the impact on the JV.Of course, no one will disagree with effective prioritisation as a principle but ensuring that these are clear and consistent is not always easy, with the biggest challenge being to align and focus of the (well meaning) diverse opinions across the parent organisation.

Influencing Plan – it is not all about voting rights

As a minority partner in a JV, you can generally be out voted if there is a difference of view with the operator, so influence rather than granted authority is important. Like most other forms of business, there is seldom a single viewpoint, and discussion and challenge are useful to shape the direction of the business. What is important is to focus on the priorities and have a coherent plan on how to influence. This will include the formal channels, i.e., board meetings, etc, but will also include a wide range of other opportunities, both formal and informal, to express opinions and shape thinking. There are often many informal opportunities e.g., site visits, technical meetings, use of secondees etc, to deliver consistent, coherent messages and these can shape and align opinions outside of the formal governance processes

The Deal can make or break the JV

Aligning Business and Deal– it goes both ways

A dealmaker can seldom guarantee that a deal delivers its promise, but they can certainly determine its failure. This is even more so for JVs, because the deal will determine critical aspects of how the business will operate in the future. Getting the business and deal elements aligned and working in tandem during the deal negotiation is therefore critical, but this is often easier said than done. Too often, it is more like a relay race, with the deal negotiating and then handing over to the business. This can lead to important aspects of how the business will deliver value being ignored or casually given away, not as part of the negotiation but through failure to understand their importance.The following shows some of the interplay between deal and business and is useful to highlight shared understanding and that key aspects of the future operation are enabled in the deal, eg the importance of standards, the handling of dividends, the contribution and rights to IP, the transfer prices to be applied. the provision of services from the parent co’s etc.

JV Due diligence – not just business as-is but how it operates

All deal due diligence focuses on the financials, what the business is worth as-is, and on a broad assessment of the business potential, again largely financial. These are the foundation of deal, but for a JV’s, there also needs to be an understanding how the business actually operates, including its culture, people and operating norms. This is essential to form a view of what is acceptable vs what may need to change as part of the deal and hence needs to be enabled in the deal negotiations.

Now is not forever – prepare for the future you didn’t plan for

Every deal has a strategy underpinning it which incorporates the current view of the future, but of course things change and evolve. A wholly owned business is free to adapt to such changes, but what if the parties have a different view of the emerging future in a JV? Too often, the provision to change, including to exit, is only covered as a worst-case option, which necessitates value loss from both parties. Such a lose/lose situation can be avoided if the mindset moves to “what-if” vs “it will never happen!”

Setting Up for Success

Many of these things are common sense and few people will disagree with them, but it is a different thing to deliver them in practice. I’m often challenged with the question – we have experienced deal makers, deal team and our business people are fully on board, why do I need anything else?In some cases that will be enough, but there is often a benefit to having a role focused on bridging between the deal and the business and drawing on experience gleaned from other, similar deals. It is like starting halfway up the learning curve vs at the bottom. You can always start at the bottom, but the risk is that you suffer the same missteps and setbacks which have already been learnt from previous deals.Bringing this experience to deal and business teams and ensuring that a successful deal also becomes a successful business is Global PMI Partners’ mission. For JVs this is even more important since, more so than in other deals, the operational viewpoint must be incorporated into the deal negotiation and structuring. Asking the right questions and drawing on previous experience, avoids omissions and mistakes, which can not only detract from the value of the deal, but can be hard to rectify in the future.

Mark Gallagher is a Senior Director in the Global PMI Partners UK team. Mark held various senior positions running businesses and managing large transformational projects. In recent years, he set up and developed Shell’s approach to delivering the value of M&A projects and has been involved in most of Shell’s large deals, including the acquisition of BG, the sale of the Oils Sands business and the divestment of Shell’s Downstream business across Africa. He is passionate about the opportunity that M&A offers to deliver step change improvements in businesses but also focused on the approach and challenges which must be tackled to deliver this potential benefit.

Global PMI Partners is a specialist consulting firm supporting our listed company and private equity clients with their growth strategies, M&A integrations and divestments, and transformation initiatives. We provide expert, on-demand M&A and transformation services and resources, leveraging our market leading approach & methodology.

With a track record of over 500 operational Due Diligence, acquisition integration, divestment, carve out and growth projects utilising our global team of over 350 seasoned professionals across UK, EMEA, North America and APAC, we are adept at helping our clients achieve the desired value from both acquisition, JV and divestment strategies. Our goal is to help our clients achieve this at a faster pace, at lower overall cost and lower risk.