The Role of Culture and Values in M&A

By Christophe Van Gampelaere, Global PMI Partners

Introduction

This article defines the meaning of culture in an M&A integration setting. It will equip the reader with a facts-based framework that allows him to address cultural differences. We make a distinction between cultural traits in organisations: some are dominant, some are shared, on some the acquirer may be lenient, on others not. We go on to values, and then give some guidance on on-the-ground implementation.

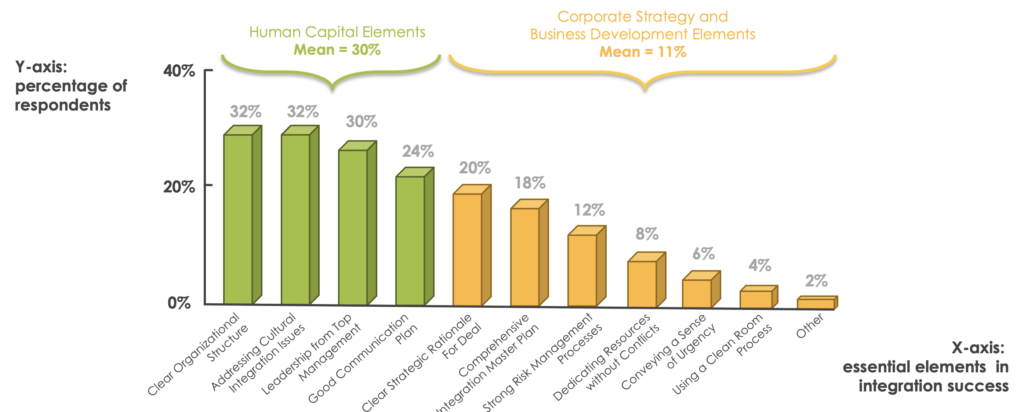

The sentiment is that cultural considerations are essential in making cross-border deals succeed. This is certainly supported by countless studies. An shows that the top integration challenges are all related to human factors—and the most important one of these is culture.

Fig.1 – The top integration challenges are all related to human factors

Definition of ‘culture’

We use a definition geared towards the needs of cross-border M&A and define culture in an M&A environment as:

“a combination of shared local and corporate norms,

behavior, symbols, values, systems and laws”.

Cross-border culture management is the systematic and facts-based management of differences between these local and corporate attributes in acquirer (the company buying) and target (the company being acquired).

For a successful culture approach to M&A, we recommend a two-pronged approach:

first, to create an awareness that by nature, most people are not conscious of the fact they’re not equipped to deal with culture; and

second, a systematic and facts-based approach to manage cultural differences. It is surprisingly easy to quantify this topic which is perceived to be intangible, and to bring it into fold with the larger integration management exercise.

Being equipped: the four stages of skillfulness in culture

In most cases, both deal and operational people are aware of the importance to manage cultural differences, however: they are not in the matter, and are not equipped with the right tools. Managers experienced in handling culture have moved through the four stages of skillfulness:

- unconsciously unskilled: a person does not understand or know how to do something and does not necessarily recognize the deficit.

- consciously unskilled: this is typically the case with seasoned deal professionals. They know to get internal or external support in the matter; they know the value of acquiring the skill.

- consciously skilled: this may be the case for integration professionals who are actively acquiring cultural skills.

- unconsciously skilled: the individual has had so much practice with the skill that it has become “second nature”.

A systematic and facts-based framework: Erin Meyer’s Culture Map

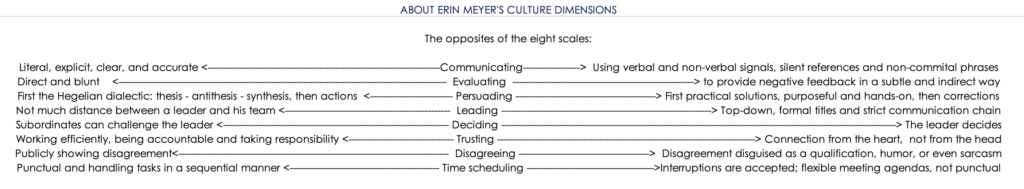

Erin Meyer, professor at INSEAD and author of The Culture Map, has created an eight-scale model, with each of the scales representing a specific cultural dimension that integration managers need to be aware of in order to increase their effectiveness.

The eight scales are: (1) communicating, (2) evaluating, (3) persuading, (4) leading, (5) deciding, (6) trusting, (7) disagreeing and (8) time scheduling. The culture of any company, country, region, person, industry, company, etc. can be mapped somewhere between the opposites of these eight scales:

Fig. 2 – Erin Meyer’s cultural dimensions

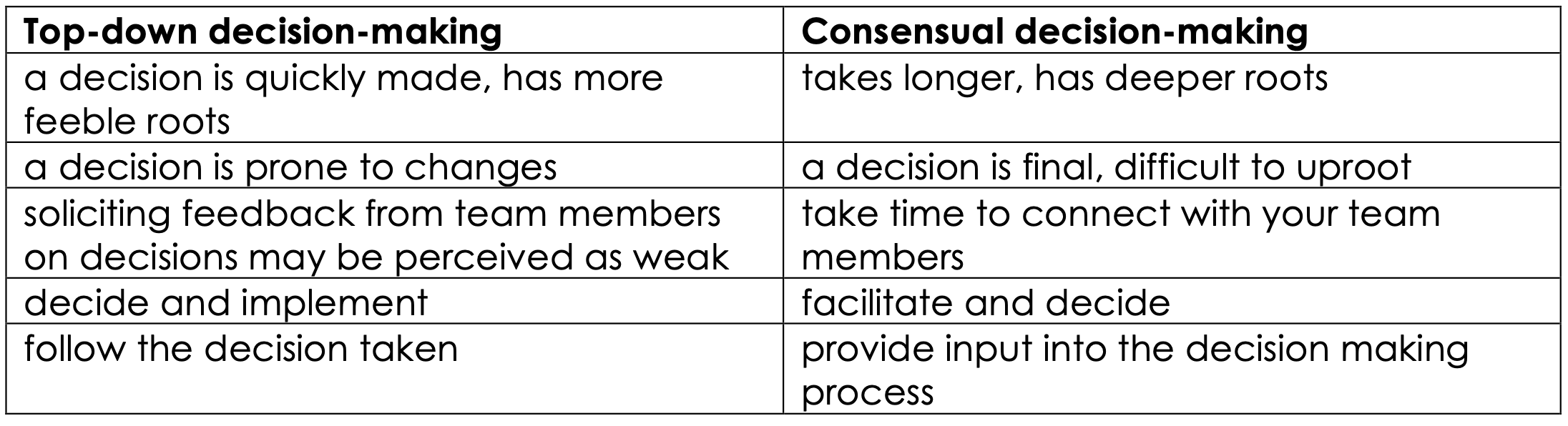

A small example is the differences in the way decisions are made between a top-down culture and a consensual one:

Table 1. – The differences in the way decisions are made

Culturally universal, culturally dominant and culturally lenient

The point is to recognize the difference between the three and knowing where an acquiring company is culturally universal, dominant or lenient. There is no judgement on what’s good or what’s bad:

- culturally universal: a culturally universal trait is one that is part of the DNA of your company, and you do not want to compromise on it. It is context-invariant and time-invariant.

- culturally dominant: a culturally dominant trait is one that in size or influence towers over the others. You will need to know where you want the acquisition target to be situated on that same axis. If both acquirer and target are dominant and far apart along a cultural dimension, it is advisable to thread carefully, and see to what extent it is possible to move closer together.

- culturally lenient: you are culturally lenient if you’re not too fussed about certain elements being different from one company – or location – to another.

About values

A company’s values are part of the contract between the company and its employees. It would be highly coincidental if this contract in the acquirer mirrors the contract in the target company. The acquirer who unilaterally changes this agreement does so at his own peril.

Some values however are universal. Every company needs them in order to function well. They are:

- the right order of positions: his is related to the goal of the organization. Whoever created the framework within which all others can function comes first. Those who create the framework for the next level down comes second, and so on. This way, everyone has a stable position, in the right order;

- a fair exchange between giving and receiving: every employee gives something to the company, and gets something in return in an ever continuing exchange;

- every person’s right to his place in the organization is equal, whether you are inventory manager or CEO, you need to have the right to work in that position. This is true for the current employees, as well as for the people who were important in the past. They need to be ‘honored’.

Practical tools and actions

How do integration managers and change agents practically go about creating cultural awareness?

Phase 1, before any deal is on the table.

- Management training: some leading companies embody management training on culture as part of their annual strategic get-together, or have dedicated online trainings. Typically, such a training module would take from 1 hour to a full day.

- Manual on culture: a manual on culture serves as a reference document and is helpful both to complement trainings as well as to serve as a standalone document. Such a manual can be handed out to anyone involved in an acquisition.

- A culture statement: a very public way of stating your identity. A famous example is the 124-page Netflix Culture Statement.

- A Cultural Competence Center: some serial acquirers have embedded the cultural workstream as an actual center of excellence within their business development team.

Phase 2, when a deal is being considered.

- Cultural due diligence: as soon as reasonable, do your own facts gathering. A cultural due diligence does not necessarily have to be as substantial as a financial due diligence. It is an iterative process, where you start with your first impressions, and you gradually work your way into more granularity as you move along the M&A timeline.

- Take stock: start with mapping what you know about the target, e.g. by checking online what Erin Meyer’s framework has on the country. Maybe you have suppliers, employees or advisors that can tell you more about the country and company.

- Compare with the facts of your own company – thiz will already provide some great insights related to behaviour, symbols and systems.

Phase 3, prior to signing.

Define your approach. Depending on whether or not you are culturally dominant or lenient on any given issue, you can:

- implement your own culture and take no prisoners;

- adjust to local culture for essential elements and build consensus;

- “pace & lead” – give the process of integrating ample time;

- not integrate, and keep the target as a standalone entity;

- abandon the deal. If you have a very strong culture with very explicit that are opposite to those in the target, you may already consider exiting the process and stop any further due diligence.

Phase 4, after signing, prior to closing.

This is a period where there is often an opportunity for more dialogue between acquirer and target. Use that to prepare for Day 1 (closing), and:

- dive deeper into mutual cultural understanding;

- map all stakeholders, such as board, management, employees, unions, suppliers, customers, strategic partners, the community, government, industry groups, …;

- make a communication plan that aligns and tailors messages across all stakeholders;

- consider using an array of communication carriers, g. an employee welcome pack, a town hall meeting, press interviews, letters, mails, a culture workshop …

Fig. 3 – Visual mapping of a culture & values workshop

Phase 5, after closing.

If you were not in a position to prepare the cultural integration prior to closing, you can still start after closing – even months or years later.

Disseminate values and culture to all levels of the organization in a uniform manner. . Leadership endorsement is key. Some companies have a dedicated culture workstream, integrated in the overall integration management office. An iterative process and frequent reinforcement of values and culture tops things off.

Summary

- Be aware of cultural differences and approach them with respect. Effectively managing them will enhance understanding and deal success.

- In a multicultural, cross-border integration team, it is key that the integration leaders understand their position on all of the cultural dimensions.

- Consider having culture workshops with your teams. They may be more rewarding than a traditional team-building event.

- Give the process of mutual cultural adjustment some time – everyone will have to move a little bit out of his or her comfort zone, but the effort is worth it – both on a business level and on a personal level.

| Christophe van Gampelaere | |

| Partner GPMIP |

About the author

Christophe Van Gampelaere is a partner at Global PMI Partners and an expert in M&A integrations and carve-outs, with a focus on culture and finance. He has led projects in Europe, the US and Asia and co-authored the books “Mergers & Acquisitions: A Practitioner’s Guide to Successful Deals” (World Scientific, 2019) and “Cross-Border Mergers and Acquisitions” (Wiley Finance, 2015). He is a lecturer on International Business Strategy at VUB University Brussels, where he pursues his PhD with the “VICARS” model, an approach to assess M&A integration readiness covering 6 dimensions: Vision, Incentives, Culture, Actions, Resources and Skills.

Global PMI Partners, an M&A integration consulting firm that helps mid-market companies around the world by delivering exceptional consistency, speed, and customized execution on the complex operational, technical and cultural issues that are so critical to M&A success.