Divestiture Series Article 2: Deal Complexity

Divestiture Series Article 2: Deal Complexity

By Christophe Van Gampelaere, Global PMI Partners

Article 2: Deal Complexity

This article is the second in a series of six devoted to divestitures. It builds on the first article of the 9 types of divestitures.

Deal Complexity

In this second article, we discuss the complexities related to a divestiture.

Complexity related to deals refers to the ability of the Seller (1) to describe the assets to be sold, (2) value them, and (3) disentangle them from the Parent company.

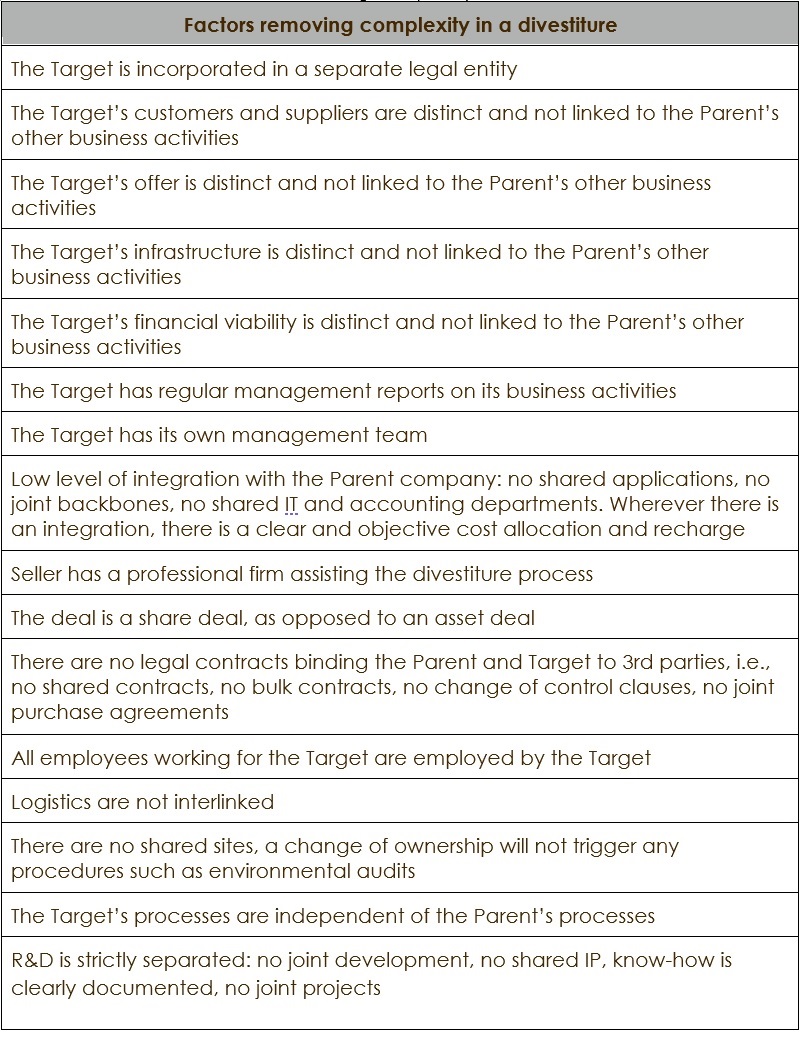

Table 1. below lists elements that remove complexity from a divestiture. Conversely, the absence of any of these elements will add complexity.

Table 1. Factors removing complexity in a divestiture

SIMPLE VS COMPLEX DIVESTMENTS

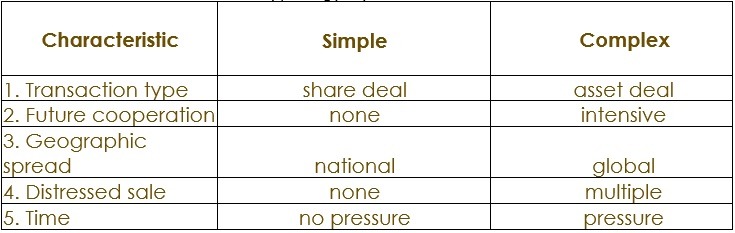

Whether or not a divestment is complex depends on a variety of factors, including: (1) is it a share or an asset deal? (2) Will there be future cooperation between Seller and Target or not? (3) What is the geographic spread?

The table below gives a summary:

Table 2. Typology by deal characteristic

The deal characteristics summarized above are not mutually exclusive. Issues and risks increase as levels of complexity increase, as explained below.

Share deal versus asset deal

An asset deal is not necessarily ‘bits and pieces thrown in a box”. In fact, it can encompass a complete business unit, or all people, assets and activities from a legal entity, and the only thing missing would be the original legal entity vehicle. There are numerous reasons for doing an asset deal. The acquirer may push for one, as it allows him to choose from an ‘à la carte’ menu, or it may protect him from potential liabilities residing in the legal entity. On the other hand, the Seller may push for an asset deal when the legal entity holds recoverable tax losses.

High versus low level of future cooperation with Target

If the Parent, Target and Acquirer need to align or partially tie in their business models, they can achieve this in a number of ways. Future cooperation can be cemented through long term service level agreements or by creating a joint venture (JV) between Parent and Acquirer.

Multinational Target

Multinational Targets are identified by their presence in multiple countries or continents. Language and culture barriers need to be overcome by the acquirer.

Even though the M&A world are aware of the importance of culture, the practical implications have yet to make it into a practical on-the-ground application.

Culture does not need to be abstract and intangible. It is a surprisingly easy topic to quantify and handle. The most important hurdles to clear are psychological ones – on the one hand not to overdramatize how difficult it is to handle and on the other hand not to brush it aside as something that will get solved automatically in due time.

A divestiture in a distressed environment

When the Parent, Target or Buyer are going through a period of distress, there is increased risk for costly mistakes and omissions. Any internal company upheaval like a restructuring, a change in strategy or the implementation of a strategic project requires management’s attention. Add to that the workload of a divestiture of integration, and something will have to give: an ideal environment for competitors to steal you customers, for employees to leave the firm, for quality issues to find their way into the value chain. All these risks are added to ‘business as usual’ at a time where stakeholders are extra watchful of the company.

A divestiture deal is announced, the deadline is set

As long as the deal is not announced, management and employees have time to prepare. There is time to map many of the risks described earlier, and to take mitigating actions. Once the divestment is made public, outside pressure from the market, investors, potential acquirers and advisers will rise. These potential Buyers will expect a deadline, and top management of the Target may push for an even earlier exit.

SPIN-OFFS, SPLIT-OFFS, CARVE-OUTS or JV’s

Divestments take the form of spin-offs, split-offs, carve-outs, or joint ventures. The terms divestiture and carve-out are often used intermittently. However, from a Parent shareholder point of view, there is a difference.

Spin-off (synonyms: spin-out, starburst)

The Parent creates an ownership vehicle that holds the activities of the divested entity, and distributes the shares of the Target to its existing shareholders. The shareholder of the Parent company continues to own Parent shares, in addition to the Target shares. The Parent shareholder ends up with shares of the Parent as well as the Target.

Split-off (synonyms: split)

The Parent offers its shareholders shares of the Target in exchange for their Parents’ shares. The Parent shareholder ends up with shares of either the Parent, or the Target.

Carve-out

The Parent sells shares of the Target. Share ownership can be open to the public like in an IPO, or closed, when a trade Buyer or a private equity firm acquire ownership. The shareholder of the Parent company continues to hold shares in the Parent company. He will not hold shares of the divested unit.

Joint Venture (JV)

The Parent shareholder maintains partial (minority or majority) ownership in the Target. The other share is sold to private equity or a trade Buyer. Some studies [1] show an advantage of a JV over an independent company in that JV’s are more cost-efficient, management is more likely to combine production factors, and benefits are derived from positive efficiency effects and the combination of skills and know-how from the two partners.

TYPES OF BUYER

The Target’s financials will look different to each category of Buyer. We recommend that the Seller consider the financials from the Buyer’s point of view, in order to enhance his position in the negotiation process.

Buyers fall into a number of categories.

- trade Buyer

- private equity

- public (IPO)

- existing management (Management Buy Out – MBO)

- new management (Management Buy-In – MBI)

- existing Parent shareholders (spin-off and split-off)

PARTIES INVOLVED

Throughout the divestment process, a host of internal and external parties will be involved: the Board of directors; strategy advisers; management; unions; the community; regulators; consultants; legal councils; tax advisors; accountants; the Securities and Exchange Commission and other watchdogs, each with their interests and challenges.

SUMMARY

In this second article, we discussed the complexities related to a divestiture and how one can approach these complexities. Then we discussed different kinds of typologies: by divestment complexity; by Target owner; and the typology of buyers and parties involved.

Article 3 in the series will dive deeper into the triggers of a divestment.

| Christophe van Gampelaere | |

| Partner GPMIP |

About the author

Christophe Van Gampelaere is a partner at Global PMI Partners and an expert in M&A integrations and carve-outs, with a focus on culture and finance. He has led projects in Europe, the US and Asia and co-authored the books “Mergers & Acquisitions: A Practitioner’s Guide to Successful Deals” (World Scientific, 2019) and “Cross-Border Mergers and Acquisitions” (Wiley Finance, 2015). He is a lecturer on International Business Strategy at VUB University Brussels, where he pursues his PhD with the “VICARS” model, an approach to assess M&A integration readiness covering 6 dimensions: Vision, Incentives, Culture, Actions, Resources and Skills.

Global PMI Partners, an M&A integration consulting firm that focuses on helping mid-market companies realise their deal objectives.