Small and Medium Sized Enterprises and the challenge of Post-Merger Integration

By Allen Gibbons, UK Associate Partner, Global PMI Partners

Introduction

For all businesses undertaking a transaction, Post-Merger Integration is a key consideration for the successful delivery of the value drivers that were the at the core of the deal thesis. One of the questions Global PMI Partners often gets asked is “how relevant is Post-Merger Integration (PMI) for smaller deal sizes?”. Many SMEs feel that PMI is only a consideration for large corporates and that SMEs can manage their deals within the capacity of current management teams – as part of their day jobs. At Global PMI Partners, it is our belief and experience that integration should be judged not by scale of organisation or size of transaction, but by the complexity of the integration strategy & roadmap. In many cases for SMEs an acquisition could be one of the most impactful and complex things they will do. It’s potential therefore to negatively impact the bottom line should be carefully considered.

The key question therefore to be considered by SMEs when undertaking a transaction is “How complex will it be to integrate the target AND what capability and capacity gaps do I have in my functional leadership to run the integration programme whilst not impacting BAU and the bottom line?”.

Challenges

The biggest challenges facing an SME, both within day-to-day business but exacerbated exponentially during an M&A process are bandwidth, focus and capability.

- Bandwidth

By their very nature SMEs often run lean organisational structures, especially at a senior leadership level. When that team has the added responsibility of leading and managing an acquisition and integration on top of their day jobs, and with potentially limited leadership capacity across multiple responsibilities functions such as Finance, HR and technology have the potential to become overwhelmed. These are often manageable within the normal course of business but adding in the burden of a transaction often requires significant additional bandwidth.

Technology, Finance and HR become key factors in the success of the acquisition. This means that unless there is a capable next tier of management with sufficient capacity, the increase in workload upon a single individual can become untenable, creating a single point of failure for the acquisition. Given that the target for an SME may also be an SME this is an issue for both acquiror and target.

- Focus and Vision

Senior leaders within SMEs are often critical in driving the strategy of the business forward on a day-to-day basis often without middle management support. It is vital that the leadership team retains a laser focus on revenue and current operations, and do not get side-tracked by the demands of a large or complex transaction. In a founder-led business where the founder has a clear vision of the future of the business, it is critical to document and share that vision to create alignment across both the acquiror and target management teams.

- Capability

With respect to capability, senior management will of course be expected to be expert in their fields – sometimes that may be multiple fields. But that does not mean they have experience of M&A and integration. It can additionally be difficult for the senior leaders to find bandwidth by delegation – if their teams themselves are small, at capacity and not experienced in integration activity. Acquisition and integration capabilities are very specific skill sets and whilst many companies may have people throughout the organisation who have been involved project delivery in some form at some level, within an SME it is less likely to be the case that they have wide experience of M&A. This increases the not achieving the value drivers which will be a critical measure of the success of the deal.

Each of these additional stresses mean that the path to a new level of growth could become derailed. There is risk for an SME that the acquisition could cause a cycle of declining BAU rather being an engine increased growth. To avoid this, it is essential that the business resources the integration team appropriately and invests in success. This means investing in appropriate expert capabilities, internally or externally.

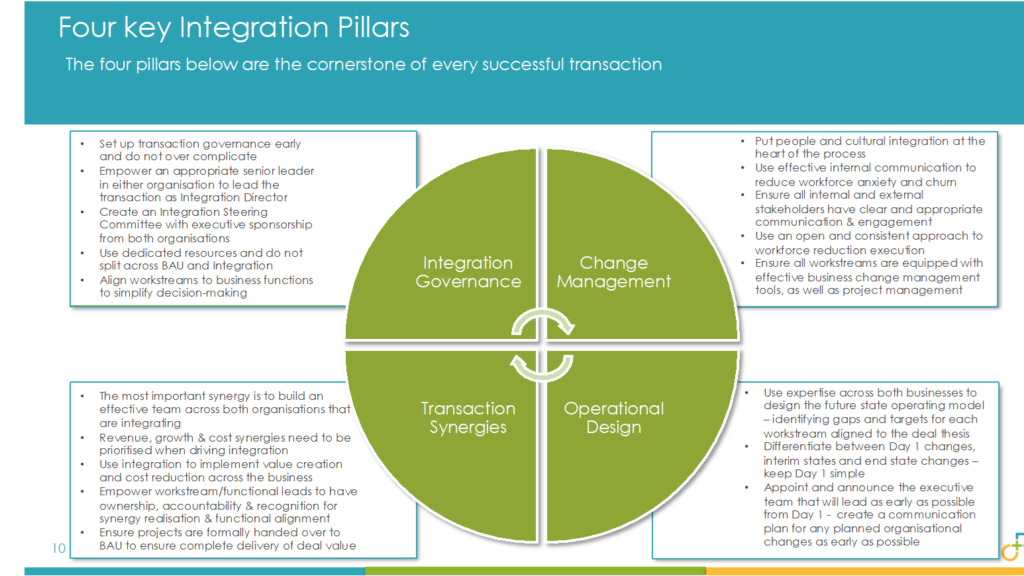

Figure 1: Four Key Integration Pillars

Planning and Support

Getting the right support is critical if SMEs are to avoid the issues outlined above and successfully deliver their deal value drives and operational integration. The support an SME requires varies in requirements from transaction to transaction and will be different depending on their scale, sector, maturity and experience of internal team – but the most significant factor as we have described already is how complex will integration be in terms of people, process and systems. That support will need to be tailored specifically to their needs and their requirements. For some deals all a client may need is a critical friend, to guide their internal teams whereas larger, more complex deals may require leadership, functional experience and additional capacity.

Planning for success begins long before closing the transaction, and ideally before even signing it. This is without doubt the single smartest way to ensure ultimate success – engaging in integration planning, whether that be internal or through external support, will ensure that the business develops an effective value-driven integration strategy and plan, tailored to the specific needs of the business.

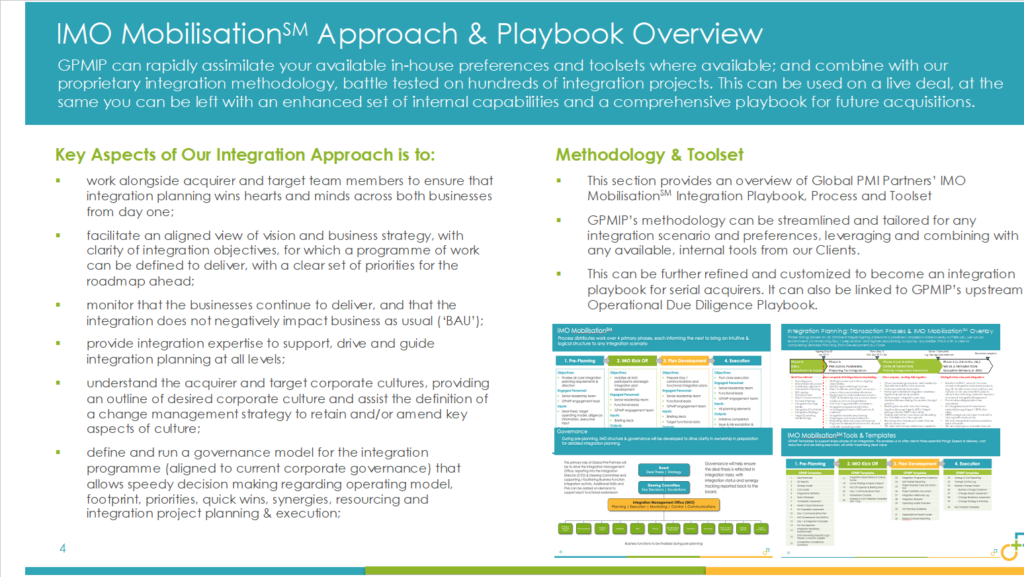

As part of its market-leading playbook, Global PMI Partners has numerous tools and templates that are built to support the integration planning and execution process, all of which can be tailored specifically for the needs of the business, including SMEs. Our Integration Directors select the tools and templates that are appropriate to the task at hand, and tailor and customise them for the specifics of the scale & complexity of the deal, type and industry of your business. There is no one size fits all and no templates for templates sake, each asset is chosen because it will be deemed to add value. For example, the full Global PMI Partners Integration Playbook (IMO MobilisationSM) contains 43 dedicated and pre-populated assets, which collectively enable companies to significantly reduce the time, cost and risk of completing integrations and to accelerate the overall speed of execution.

Figure 2: Global PMI Partners IMO MobilisationSM Overview

Rob Kerr, GPMIP’s ASEAN Regional Lead puts it this way “Our process is always rigorous, and we ensure that every task we ask a client’s team to undertake adds value to the integration process and delivers against the ultimate objective. This is our commitment to all our clients, no extraneous work, no extraneous costs”.

Having a plan supported by a suite of proven, appropriate tools and templates will help ease all the issues highlighted previously. Having experts working with you (internal or external) to develop the integration plan eases bandwidth on the senior leadership, minimises the loss of focus with the tools and templates helping to support gaps in capability. Additionally, this will begin to develop a ‘muscle memory” within the business that will help with future acquisitions. It can also develop a playbook for those future deals something that dealmakers cite again and again as a reason for success, as noted every year in Global PMI Partners annual M&A Success Surveys.

Plotting the journey from the As-Is to the To-Be

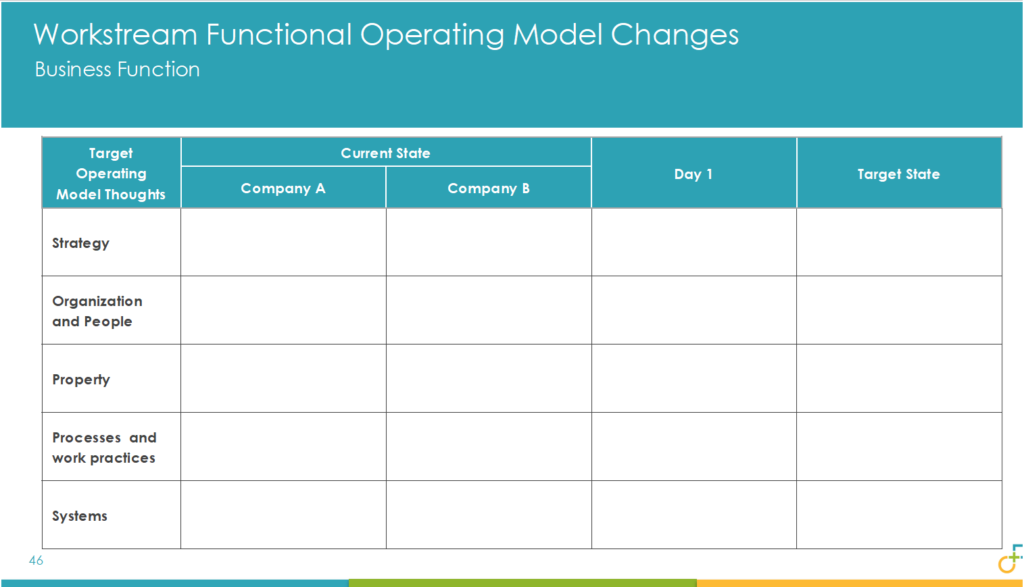

A key task for any integration is to ensure that a clearly structured future state for the combined new business, post-acquisition is developed. This target operating model or ‘TOM’ is not only critical for the future operational performance of the business but also for giving functional leaders a clear vision upon which they can base their own, functional integration roadmaps.

Senior leaders often think of the future state dependent on their functional or operational background: for example, what will market share will look like? What will be our product range as a result and how will I maximise cross and upsell opportunities? What will topline revenues be? What will the future organisation and reporting lines look like? Detailed plans need to be developed to deliver the answers to all of these and many other questions, all of which may iterate many times once integration begins. Having clear integration planning checklists for all business functions really speeds up the process of identifying and prioritising tasks, to ensure constant focus on value, without disrupting business as usual (BAU).

Global PMI Partners have a simple model that ensures that functions spend time thinking about the “As-Is”, in other words, what is the current state for both the target and the acquiror across several key areas as well as the “To-Be” for both Day 1 and the final end state of integration overall. The first iteration should be completed as early as possible, ideally before formally kicking off the integration programme at what GPMIP refer to as Integration Kick-Off. This uses and builds on all of the insights and outputs from the diligence process and deal thesis, as they provide a clear understanding of the similarities and differences in terms of organisation, process and systems for each business function across both organisations. This level of planning leads to greater integration success by assisting the identification, alignment and costing for integration i.e., what is the future state.

Figure 3: Functional Operating Model Changes

Using this approach as a discipline in the planning process encourages functional and business leaders to identify and then address issues, risks and importantly opportunities that may otherwise have been missed.

Understand Complexity and Resource Appropriately

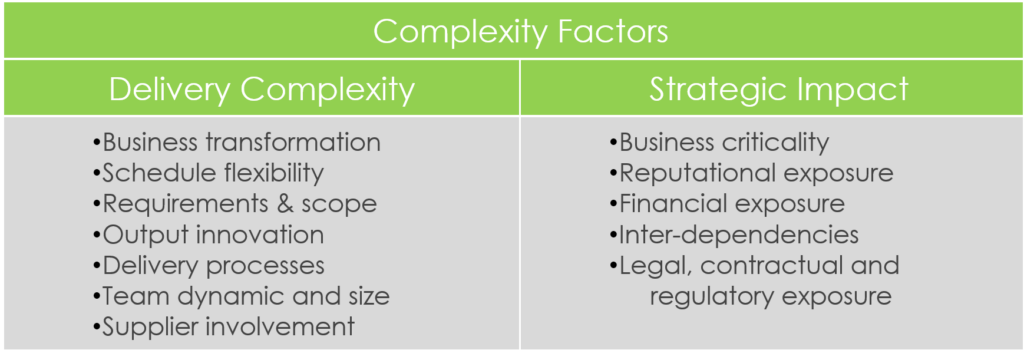

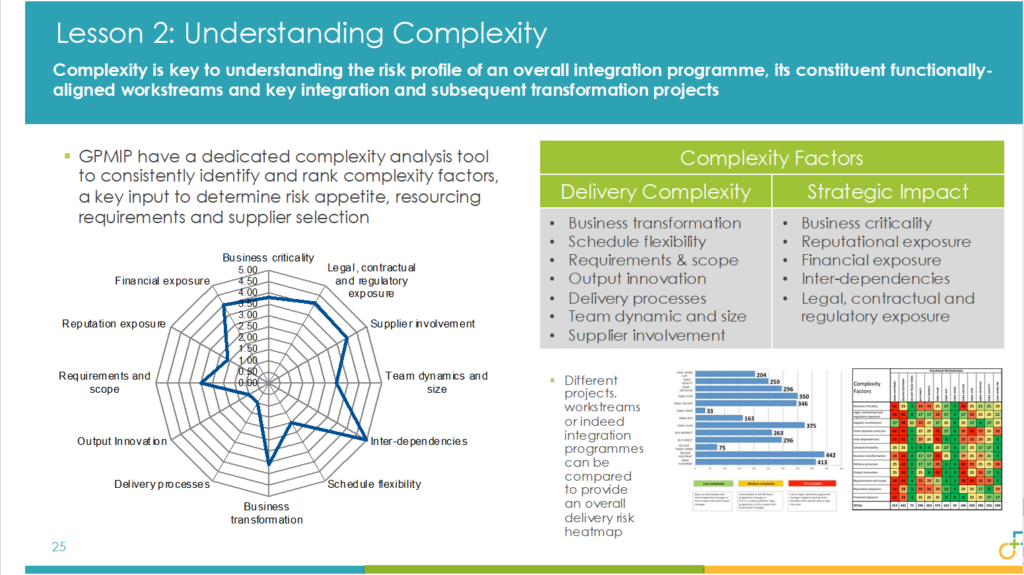

As we have noted throughout this article, SMEs need to assess is the complexity of the transaction, and consequent integration activity. Complexity analysis and mapping can be used to identify the capabilities and bandwidth of your existing team and their ability to deliver the benefits of the forthcoming integration. Complexity is a function of several factors, as shown below.

Figure 4: Integration Complexity Factors

Each of these factors can vary and are dependent on the workstream or function within the business. Getting your integration team to analyse your internal capabilities and understand the complexity of the integration for each business function, as well as the integration as a whole, is key to delivering a successful outcome. Complexity mapping will enable you to make accurate and timely decisions on what team you need to mobilise, to assess internally your experience against the forecast demands for the transaction and then to decide what, if any, external support you may need to engage.

Figure 5: Example Complexity Analysis

Resourcing aligned to complexity is a key integration decision and if done properly will increase the probability of a successful integration for an SME. No business, especially an SME, wants to over-resource, however, under-resourcing can be equally risky, and is one of the most common causes for not delivering the full value potential of an M&A deal.

Successful SME acquirors frequently supplement their in-house teams with specialist external expertise, and usually combines a mix of the following:

- External Leadership for the Integration: This involves bringing in a highly experienced, external resource to lead the project, typically reporting to the CEO (and dedicated Steering Committee) to ensure that the transaction has the requisite skills, whilst also working with the internal team to avoid unnecessary impact to BAU operations. This is usually in the form of an Integration Director and can be supported by an Integration Management Office (IMO) Manager for, larger more complex transactions. These roles can sometimes be combined, depending on a number of factors from deal size, complexity, maturity of the business, strength of internal functional leadership and inherent M&A experience already in place.

- External Functional Subject Matter Experts: These are the most flexible of resourcing options and can be used in several ways:

- Workstream Leadership or Support: Where a functional leader cannot make sufficient bandwidth available due to BAU requirements an external Subject Matter Expert can be employed to lead or support any of the individual workstreams identified for the project.

- Resource Backfill: Where it is judged that a particular leader is critical for Integration Workstream Leadership but cannot be released due to BAU considerations, some SMEs opt to bring in an external BAU backfill resource to free the functional leader up to focus on the deal. This transient resource can then be released when the functional leaders can absorb both BAU and integration workload.

Understanding the correct level of support requires clarity around bandwidth, capability and complexity and is a key aspect of the planning role undertaken by the Integration Director and the business leadership.

People and Culture

Integration is often not a purely objective and rational process; much like business it isn’t because the key component is people. Change can be unsettling for people and acquisition and integration can bring about significant changes to the workforce. Communicating with people at all levels within the organisation, even at very senior levels, will be vital as so many people will not be aware of what is going on or why and most importantly what it will mean for them. Consequently, information gaps that are not managed appropriately and with care may be fuel rumour and conjecture which often feeds people’s fears, what is needed is a constant stream of communication across all levels of the business in order the share, as much as possible, the reality of the often changing situation.

We always advocate to constantly communicate, through multiple different forums, groups, and communications channels – basically listen as much as you talk and take questions and be honest. There will be things that may not be possible to reveal at certain times, either because they are not ready for announcement, or simply as they have yet to be decided. So, share what you can, as early as you can and be ready to answer questions on issues where decisions may be taken late and critically don’t miss committed deadlines. Ensuring high levels of engagement underpins integration success, and a culture of honest and regular communication can provide a welcome means to navigate many of the uncertainties of an integration process.

Global PMI Partners implement a short cultural due diligence survey to help prepare the team for the coming integration challenges, whilst highlighting both the similarities and differences in expectations and cultures of the two teams coming together (this only takes survey participants roughly 5-10 minutes to complete). This provides a key input for the integration plan and allows the integration team to be cognizant of culture when agreeing and implementing those plans. We also advocate assessing the culture of leadership to identify any the challenges that a business will need to plan for.

Conclusion

M&A is a significant opportunity for the SME community but one that comes with risks that are harder to mitigate given the smaller internal resources available to draw upon. These specific challenges and indeed greater risks given the size, structure and capabilities of the internal SME teams can be overcome with appropriate planning and managing execution in a way that is sensitive to the needs, structures and challenges that SMEs face. This plan must include a clear and detailed vision of the future state for the combined business, a roadmap to achieve it, with appropriate and sufficient levels of resourcing, whether internal or external, to deliver deal value, integration success and most importantly of all, to protect BAU.

Allen Gibbons is a UK Associate Partner for Global PMI Partners UK. He has over 30 years’ experience across Consumer Goods, Media, Tech and Professional Services in Europe, North America, Asia and Sub-Saharan Africa as CEO and Transformation Consultant. He has led M&A projects from target identification through due diligence, deal negotiation and post-merger integration.

GPMIP is a specialist consulting firm supporting our listed company and private equity clients with their inorganic growth strategies and M&A integrations and divestments. We provide expert, on-demand M&A services and resources, leveraging our market leading M&A approach & methodology.

With a track record of over 500 operational due diligence, acquisition integration, divestment, carve out and growth projects utilising our UK team of 170 seasoned professionals (400+ globally, across EMEA, North America and APAC), Global PMI Partners is adept at helping our clients achieve the desired value from both acquisition and divestment strategies.