Socio-cultural Influence on Post-merger Integration Performance

By Michael Holm, Nordic Partner

In addition to Global PMI Partners’ core business of M&A integration consulting and training, we actively support universities through the promotion of research, lectures, and our annual M&A Survey. Below is an article based on the thesis by Mr Benedikt Biedermann at Vrije Universiteit, Amsterdam relating to the Socio-cultural Influence on Post-merger Integration Performance.

Implications for PMI practitioners

Mergers &Acquisitions are often believed to fail due to financial and economical mismatch while other influencing factors remain neglected. The results of Mr Biedermann’s study prove that socio-culture acts as an equivalent determinant to explain PMI performance which ultimately determines the outcome of an M&A. The findings raise awareness for PMI practitioners to recognize the relevance of a shared organizational identity across the combined company in order to have them pull and work together. Having this in mind, PMI practitioners can draw on shared identity promoting activities and communication to foster social cohesion, dismantle prejudice and betray harmful ideals. Furthermore, the study shows that the less organizational cultural differences the greater the employees’ willingness to cooperate, implying acquirers to rather choose to acquire a firm that exhibits analogical organizational behavior. Mr Biedermann argue that this is rather the case with national than international target firms.

In this context dealmakers and PMI practitioners also need to bear in mind that the choice of integration approach can effectively influence the PMI performance. The fact that choosing a symbiotic integration approach moderates the relationship between negative emotions and the willingness to cooperate, supposes that within M&As during difficult times or in complex economic environments that involve high levels of emotions, a collaborative approach fits best in order to make the M&A successful. Hence, dealmakers and PMI practitioners need to be aware that when carefully choosing the most appropriate integration approach, PMI performance outcomes can be effectively positively (or negatively) influenced.

Master thesis findings:

The majority of management and M&A research takes financial considerations into account to explain post-merger integration performance; yet the soft side factors remain neglected while often being even more influencing and decisive.

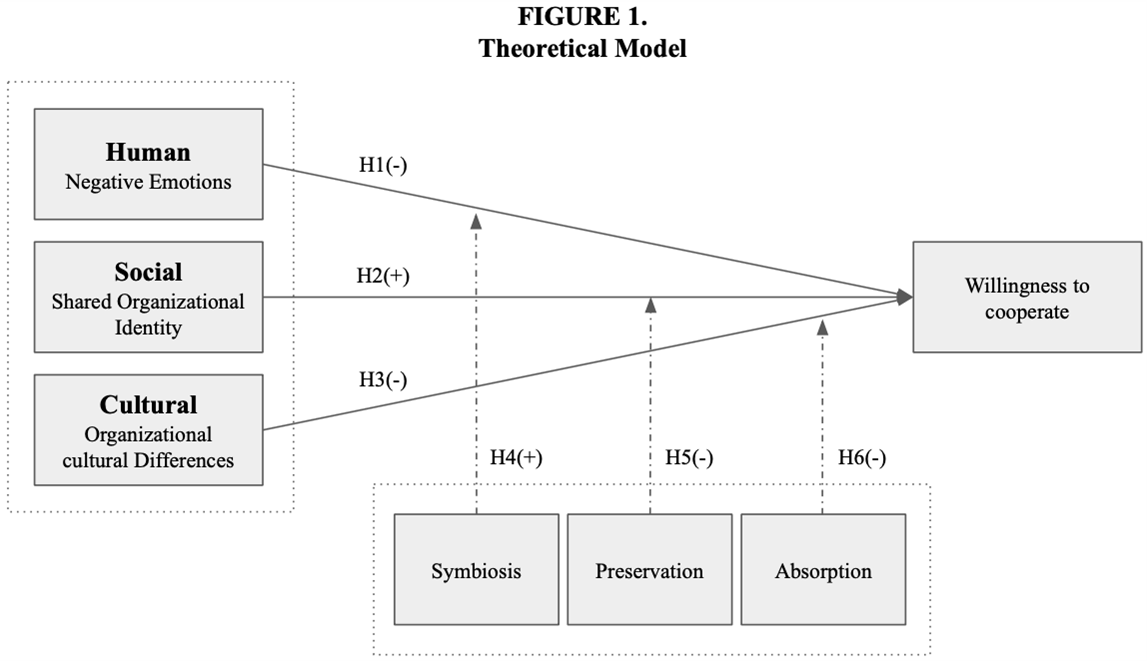

In order to best address this issue, Mr Biedermann developed a three-pillar holistic socio-cultural influence model by using the following independent variables as an explanation for socio-culture:

- The human factor: negative emotions

- The social component: organizational identification

- The cultural part: organizational cultural differences

The variable to measure performance, was employee’s willingness to cooperate (in the post-merger organization).

Assumptions/Hypotheses:

Mr Biedermann assumed negative emotions to be negatively related towards PMI performance, however was not able to find statistical significance. Further he argued organizational identification to be positively related to PMI performance, which he was able to prove. Similarly, he also showed that organizational cultural differences clearly negatively influence PMI performance.

Moderation:

Additionally, Mr Biedermann further introduced a moderating variable, namely the type of integration approach.

Interestingly he found that when choosing a more symbiotic approach, the relationship between negative emotions and PMI performance becomes more positive – this indeed would also imply weak (!) evidence for his first, not supported, hypothesis that negative emotions are negatively related to PMI performance.

Furthermore, he argued that when choosing preservation, the relationship between organizational identification and PMI performance becomes less positive – assuming that a shared organizational identity is unlikely to arise if both parties remained “closed” and unwilling/not meant to integrate. However, he was not able to find statistical significance.

Same applies for the third integration approach absorption where he expected that when choosing such approach the negative relationship will be moderated and fostered in an even ‘stronger’ negative way. Unfortunately, the statistical significance in this case was there, but too low to accept the hypothesis.

Some quotes from the thesis:

“Interestingly our data proofs our assumption that a more cooperative and mutually beneficial integration approach, symbiosis, reverses the negative relationship and facilitates a more positive relationship between negative emotions and the employee’s willingness to cooperate.”

“Our results indicate that although employees might perceive negative emotions related to the M&A, no significant prediction in relation of their post-merger behavior can be derived from our data.“

“The significant positive effect of a shared organizational identity in our study clearly shows that employees are more willing to cooperate when they identify with the organization and feel strong ties.”

“Our data further reveals that younger employees on average are more likely to cooperate than their older colleagues.”

“Moreover, our study emphasizes organizational cultural differences to be an influencing factor for counterproductive cooperation behavior.”

“Furthermore, our study proves the common conclusion that willingness to cooperate is higher in national carried out M&As than when the transaction takes place across borders.”

“Our study hereby discloses that the negative relationship between negative emotions and willingness to cooperate is moderated such that the relationship becomes more positive when choosing a symbiotic integration approach. Contrary to our expectations we did not find a significant influence for the integration approaches preservation and absorption.”

“The employees of firms operating in younger and more fast-paced industries might behold M&As as more positive due to potential growth and development prospects while on the other side personnel of heritage-driven firms fears loss of control or identity. Hence, responses on how emotions, identity and cultural differences are perceived might differ significantly across industries, acting as a risk factor to encumber statistical significance.”

Please note that the above is kept short. For a more detailed look please see the thesis online at VU Amsterdan: https://www.ubvu.vu.nl/pub/fulltext/scripties/27_2700721_0.pdf

Michael Holm is a Partner at Global PMI Partners, an M&A acquisition integration consulting firm that helps mid-market companies around the world by delivering exceptional consistency, speed, and customized execution on the complex operational, technical and cultural issues that are so critical to M&A success.