Article Series: Divestitures

Article 1: Introduction and the 9 types of divestitures

By Christophe Van Gampelaere, Global PMI Partners

This article is the first in a series of six devoted to restructuring/divestitures (through carve-outs, spin-offs, split-offs, split-ups, and joint ventures).

This article presents 9 possible types of divestitures, along an increasing level of deal complexity.

After reading this article you should have a clear overview of what types of divestitures there are, together with their complexity.

1. Introduction

Article learning objectives

In this series of articles you will learn about:

- various types of divestitures

- what triggers a divestment

- elements of a divestment process

- Transition Service Agreements & stranded costs.

Main issues addressed in this article

This article starts with a description of the various types of divestitures. It goes on to present a framework wherein these occur. The framework covers the process from end to end. It starts with the rationale and triggers for divesting, it goes on to assess the impact on the Parent company, the Target and the acquirer; it describes associated risks and issues and the parties involved in a divestiture. It touches on how to prepare for an exit and how to become either independent or integrated into the buyer.

We go deeper into theoretical elements of a divestment process, covering the phases in a divestiture process, and we provide the reader with some useful templates and leading practices. We end with an overview of lessons learned.

Examples, data and charts are peppered throughout the chapter, and the reader is provided with some useful tables, tools and templates.

2 Types of divestitures

What is a divestiture?

A divestiture is a term covering a broad spectrum of activities where a parent company divests itself of part of its business. Divestitures range from simple, standalone events to complex undertakings with far-reaching ramifications. We call the divested entity the “Target” (reflecting the Acquirer’s point of view). The term ‘Target’ is generally accepted and understood in the investment community. We call “Parent” the company that divests.

Divestiture typologies

Typology by divestment complexity

Any divestment requires an upfront strategic analysis by the Parent on the rationale behind the divestment.

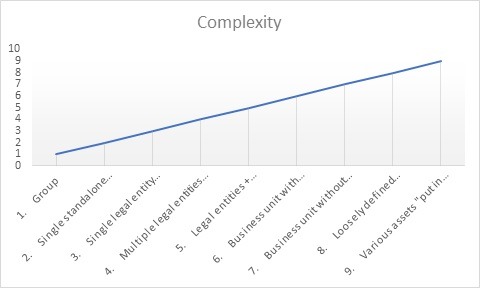

There are nine distinct types of divestiture targets, depending on the complexity to divest the business. Below there is the list of these nine different types listed in increasing complexity order: as shown in Fig. 1.

Fig. 1. Increasing level of deal complexity

We identify 9 target types:

- Group of companies / large company

- Single small standalone entity

- Single legal entity connected to the Parent

- Multiple legal entities connected to Seller

- Legal entities + certain assets or people

- Business unit(BU) with history of BU reporting

- Business unit without BU numbers

- Loosely defined operational unit

- Various assets “put in a box”

Type 1: group of companies / large company

This is the situation where the Parent sells a group of companies or one single large company.

The complexity from a divestiture point of view is relatively straight forward. None of the above factors adding complexity to the deal apply. There is still significant work to be done however. GPMIP’s Acquisition and Carve-Out FrameworkTM, described further in subsequent articles in this series, notes the need to prepare the Target to be put on the market and facilitate the acquirer’s due diligence process.

Type 2: single standalone small legal entity

This is the situation where the parent sells one single standalone small company.

The additional complexity of selling one standalone legal entity versus a group of companies is related to the ease in finding the right acquirer. The smaller the entity, the more diseconomies of scale play a role in preparing the target for a sale.

Commissioning a Vendor Due Diligence report is relatively more expensive – as is setting up a dataroom and hiring advisors to prepare.

Type 3: single legal entity connected to the Parent

This is the situation where the Parent sells a small legal entity that shares some functions with the Parent, for example same admin department or same IT department or same facility.

If the Target is a distinct legal entity, but is connected to the Parent, the issue of Transition Service Agreements comes into play. Being connected to the Parent means that certain group functions are provided by other companies in the group. These functions can be anything, but IT, Finance, HR and Legal are often at least partially provided by related group companies.

Transition Service Agreements are treated later in this article series, and are typically short term agreements between the Target and the Parent, to provide a certain level of services, for a limited duration.

Type 4: multiple legal entities connected to the parent

This is the situation where the Parent sells several small companies all of them related with the Parent company.

Complexity is added as these entities are interconnected, but have no group structure to hold them together. The acquirer may have to build such a structure or integrate the Target into its existing structure.

Type 5: combination of legal entities + certain assets or people

Same as above, but the Target will include some people or assets from the Parent.

When distinct assets are added into the mix, those assets will have to be disentangled from the Parent. Transferring people out of one legal entity into another triggers issues on areas such as pension plans, share schemes, work permits.

Type 6: business unit with distinct reporting to the Parent

In this case, the Target is not a standalone legal entity but it is a department or a business unit of the Parent reporting to a well identified person in the Parent.

When a business unit is being sold, without it being housed in a legal entity, we enter a completely new realm. Assets, people, systems, policies, procedures, and contracts will all be affected. The acquirer can still obtain some clarity on the business performance, since there are management reports. The question is how those reports can at all be tied into the Parent’s reported figures, and how much of costs and revenues can really be allocated to the Target.

Type 7: business unit without distinct reporting to the Parent

Here, the target is a business unit of the Parent but there is not a clear reporting to a specific person of the Parent, i.e. the business unit reports to different people

The lack of distinct reporting adds another layer of risk for the buyer. That risk will be discounted in the acquisition price. On a positive side, there is still an organizational unit, and members of that unit will be able to provide some clarity on business practices. They will often very much be performing part of their functions for the Parent company and dividing up the organization may not be a straightforward exercise.

Type 8: loosely defined operational unit

Same as above, but the business unit does not have a clear perimeter.

This type of target lacks the organizational clarity of the previous type and makes all divestiture and integration activities that much more difficult.

Type 9: collection of “bits & pieces in a box”

The Target is not even a business unit with a loosely defined perimeter but it s a collection of people and assests “scattered” here and there in the Parent company.

The most complex divestiture, both for buyer and for seller, is the “bits & pieces in a box” deal. Anything can go in, like:

- fixed, tangible or financial assets, licenses, intellectual property, client lists

- liabilities such as payable, loans, payroll liabilities; some are difficult to transfer, like tax liabilities, potential claims, off-balance sheet obligations

- some assets are hard not to transfer, like land, a factory, people, inventory, contracts.

Summary

In this first of a series of articles, we have presented you with 9 possible types of divestitures along an increasing level of deal complexity.

You should now have a clear overview of what types of divestitures there are, as well as some insight into the complexity of each type.

Highlights of the literature

- The Business Model CanvasTM as a divestment decision making tool

- Global PMI Partner’s Acquisition Carve-out FrameworkTM

The takeaways from this chapter

- Divestment typologies by divestment complexity, by deal characteristic and by target owners

- Transition Service Agreement Template

- Divestiture program structure

- TSA governance structure

Christophe Van Gampelaere is a partner at Global PMI Partners and an expert in M&A integrations and carve-outs, with a focus on culture and finance. He has led projects in Europe, the US and Asia and co-authored the books “Mergers & Acquisitions: A Practitioner’s Guide to Successful Deals” (World Scientific, 2019) and “Cross-Border Mergers and Acquisitions” (Wiley Finance, 2015). He is a lecturer on International Business Strategy at VUB University Brussels, where he pursues his PhD with the “VICARS” model, an approach to assess M&A integration readiness covering 6 dimensions: Vision, Incentives, Culture, Actions, Resources and Skills.

Global PMI Partners, an M&A integration consulting firm that focuses on helping mid-market companies realise their deal objectives.