A (real) Cultural Due Diligence is often like the Loch Ness Monster: everyone talks about it, but no one has seen it.

By GPMIP France Associate Partner, Cedric Woindrich

For decades, the focus in acquisitions was on finding the good strategic fit. In recent years the accent shifted to the acquisition process, especially the integration phase. In parallel, after originally concentrating on financial and legal aspects of the transaction, more emphasis has been put on “soft” aspects. In particular, “cultural” fit has been publicized as a key success factor – or a major reason for failure – in many acquisitions. We all recall the misfortunes of AOL and Time Warner, Sprint and Nextel, Hewlett Packard and Compaq, or Daimler and Chrysler…

Yet, a real analysis of the cultural fit, or “Cultural Due Diligence” (CDD), is still performed very rarely in acquisitions today. Often the CDD is at best a self-performed description of the acquirer’s values, quickly put in perspective with what is perceived to be the values of the targeted company. Since most companies now advertise their values on their websites, that is the quick and easy path.

Comparing values is barely scratching the surface

There are however many flaws in this approach.

- First, values are often self-proclaimed, and history has shown that reality can be slightly different: remember that Enron had “integrity” as one of its core values!

(This potential bias concerns not only the target, but the acquirer as well.)

- Values are only the invisible foundation of the culture of a company. They are far from sufficient to perform an evaluation of the cultural differences between two organizations, and understand their impact on team work orientation, decision-making mechanisms or conflict management to name just a few.

- Within very large organizations, different divisions may have sub-cultures that differ significantly from the recognized corporate culture.

- Although the CEO and a few top executives are clear drivers of a firm’s culture, their perceptions or wishes may be different from what is happening in the field. Words from the top management are of utter importance, but they do not suffice.

A CDD should be prepared ahead of time

There are also numerous obstacles to performing a good CDD.

- The subject is complex! Whereas national cultures have benefited from widely recognized research and helpful tools (e.g.: Hofstede’s work), there is no such popular model to describe a company’s culture. In addition, when dealing with a cross-border operation, both dimensions (country and company) can intertwine and make the analysis even more complicated. Think of a decentralized French company acquiring a division of a centralized Swedish group…

- The need for secrecy and/or legal restrictions prevent openly performing large studies during the acquisition process.

- A prospective acquisition tends to quickly become an emotional subject. A CDD may uncover unpleasant risks linked to the operation, and thwart top management’s initiative or other stakeholders’ desire to carry on.

- Unlike financial or technical matters, a CDD is subject to interpretation, and may raise more questions than it brings answers.

In spite of all that precedes, it is possible to prepare for a CDD. The first step, the cultural assessment of the acquirer, can (and should) take place long before an acquisition process is initiated. Modern communication tools make these inquiries faster and cheaper than ever. And once a Cultural Due Diligence process begins, the target company can internally mandate a similar approach on its own, following the same methodology (or simplified if time is short) as the acquirer.

Once a “real” CDD has been performed, the question of which course of action to take remains. A CDD will identify cultural similarities and cultural gaps. It is obvious that similarities should be built upon. For example, if both organizations have a high level of control, people will feel comfortable building a system in common. But what about cultural gaps?

“Culture change” makes no sense

The dominant school of thought (mostly of North American inspiration) is to carry out integration as quickly as possible. In dealing with cultural gaps, a quick integration process calls for a “culture change”. This makes no sense. Culture has, among others, two characteristics: it shapes itself very slowly, and it exists only through people. If you want to change a culture quickly, there is only one solution: change all the people at once. Buying a company to entirely replace its human component makes, however, very little sense…

Culture will not be “changed”. It will evolve – slowly, and generally on both sides. Yet, acquirers want to realize synergies quickly, and aspire to rapidly achieve some sense of integration with their newly acquired target.

A CDD should result in two separate action plans

To do that effectively, acquirers need to build on commonalities, but they also need to address gaps in two ways, clearly distinguishing short and long term:

- In the short term (ie: during the integration official project phase):

- face those gaps and communicate openly on them

- build a common understanding on why those gaps can be problematic, recognizing on both sides that in an acquisition there is an acquirer and an acquired…

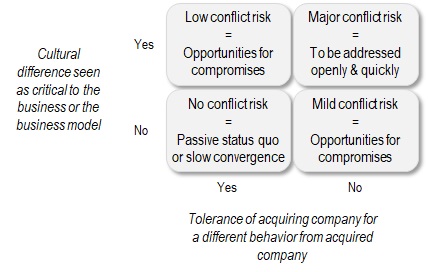

A matrix like the one below can be used to prioritize on actions and communication:

3. indicate that differences should be addressed in good faith from both sides. The previous step is a good opportunity to remind both parties that each one needs to make a step towards the other.

- Start working on a longer term plan with combined teams to structurally address the cultural gaps, while communicating that this will be a long term effort on both sides.

It is important to separate both initiatives: the short term plan belongs to the integration project (which should have a defined end), whereas the long term plan is part of the transformation of the company.

Even though a CDD is important, it is still only one of the Key Success Factors of a successful acquisition, and it should be considered in the context of the whole project, both on the synergies and the risks sides.

In summary, our recommendation is to:

- Perform a cultural self-assessment as early as possible in the M&A strategy design (well in advance of the launch of an acquisition process, otherwise no one has time to do it anymore), and build internal capabilities around the methodology, so that it can be used later on for potential targets.

- Once a CDD is performed on a target, review the results realistically, and identify related business strengths as well as risks.

- Design two plans: one for the short term, simply recognizing cultural gaps and establishing a common understanding of each other ; and one for the longer term, to work on a well-designed (and well-monitored) osmosis.

I welcome your comments. If you find this article useful or thought-provoking, please share it with other members of your network. Comment and “Like” this post on LinkedIn by clicking here.

About Global PMI Partners

Global PMI Partners is the only global consultancy firm focused exclusively on merger integration and carve-out services. With offices across the US, Europe and Asia, Global PMI supports both private equity as well as corporate acquirers.