M&A Integration Planning Essentials for Executives

Upcoming Date: November 20-21, 2017, Stockholm, Sweden

Course Overview

Held in a boardroom setting with a maximum of 20 participants, this combination course and workshop is designed for management teams leading the transition from pre deal integration on to deal execution and up to operationalization.

Who Should Attend

Corporate leaders preparing for strategic acquisitions. Senior leaders in corporate development, strategic planning, program management, finance, legal, operations, IT and HR.

| Request enrollment information by clicking here or contact Sheila Mayfield for more information Sheila.Mayfield@gpmip.com +1 415 738-8109 x858 | Click here to download brochure | Interview with Thomas Kessler and Michael Holm both leading M&A authors and joint course instructors https://www.youtube.com/embed/qIrQOQVnL-M |

Feedback from Attendees

“The best thing about working with Thomas (in the PMI for Executives Class) is that he is able to simplify concepts to the level of a novice student on Post Merger Integration (PMI) like me. His vast experience on PMI enables him to competently respond to the complex questions by my co-participants who are Merger practitioners. He is also very understanding and accommodating.” –Voltaire Pablo P. Pablo, III, Vice President – Human Resources Management Group, Land Bank of the Philippines

“Thomas has the unique ability to take this broad and complicated topic of M&A, and make it easy to understand and relevant for each participant’s need and situation – regardless of their background or experience with M&A. As well Thomas made it easy for me (and all participants) to engage with the material – providing real world examples and leveraging his deep experience providing thoughtful answers that demonstrated his understanding of each participant’s particular interest or situation.” –Jim Winslow, Principal – Steady Consulting, IT strategy, change/transformation

Course Topics

Day 1: Essential Elements of Integration Planning

Introduction

Setting the stage on M&A, current trends, and the M&A life cycle

Pre Deal is Post Deal

- Selecting Deals with the Integration in Mind

- Integration Due Diligence – The Next Generation Framework

Post Signing and Pre Closing

- Integration Planning Framework and Team

Which steps and skill-sets will secure your ability to capture the value you expect from the deal?

- Managing the integration pro-actively. How to program your integration for success?

- How to structure your M&A integration program management?

- How many resources do you need?

- Who should be part of the PMO?

- What reporting lines do you need to establish?

- What reporting approach will benefit your integration most?

- DayOne Planning – How to secure true control over your acquisition

- Case Study

Connecting the Dots – Pre-requisites for successful integration and value creation

- Implementing Effective Stakeholder Oriented Communication

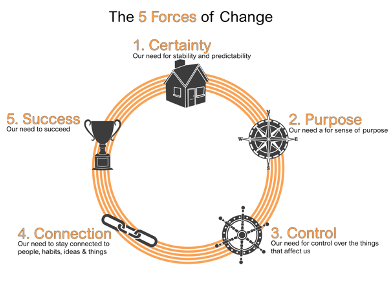

- Diffuse anxiety and promote value creation

- Structure communication to be effective and informative

- M&A integration communication for public companies

- Case Study

DayOne, First 100 Days and Beyond Communication

- Key messages that create engagement in the joint business?

- Ensure stability, revenue focus, strategic direction and clarity where to move from here

- Build momentum and motivate staff and management

- Incentivize joint initiatives towards value creation

- Messages to other stakeholders

- Keeping communication between stakeholders going and have your finger on the pulse

Day 2: Essential Elements of Integration Execution

Synergy analysis

- Synergy assessment framework and types of synergies

- Process linking data collection, evaluation, timing, with decision making and reporting

- Criteria that facilitate the tracking of the synergies post implementation

Turnkey Events

- Executive Alignment

- Synergy Working Session

- Transition Team Launch

Cultural alignment

- Keeping strong performing people

- Steps to align and implement a joint new culture

- Behavioral differences of both organizations

- What is measured gets done – really?

- How and through which means you can trigger change

- Diffuse difficulties and critical issues amicably

- Case Study demonstrating the use of psychometric tools in cultural alignment

Organizational reframing

- Clarify roles, responsibilities and define the new organizational design

- Value stream mapping of key business processes

- Best practice approach versus fast and accelerated implementation value creation

- When to accelerate organizational integration and when to take your time?

- Implementation tracking and reporting

Functional Integration

- Key steps to integrate the Sales, Marketing, Finance, Procurement, R&D, IT, and HR

Building a firm wide PMI network

- Build your internal talent pool for the next deal

Format

- 2 Day executive course and workshop

- Boardroom setting

- Maximum 20 participants

- Course materials provided to all

- attendees

- Breakfast and snacks provided

Pricing

29,950 SEK per attendee. 25,950 SEK per attendee if registered 60 days prior to course start, or for companies with 3 or more participants.

Cancellation Policy

Cancellations or deferrals must be submitted in writing more than 30 days before the program start date to receive a full refund less 10% processing fee. Due to program demand and the volume of pre-program preparation, cancellations or deferrals received less than 31 days before the program start date will be charged in full.