Stalled value creation? Steps to address the 3 common value creation roadblocks.

Common execution bottlenecks that delay value realization and steps to address them.

By Global PMI Partners

Objectives of article

- Summarize the typical value creation strategies for PE sponsored platform companies.

- Define the value realization challenges that manifest during integration activities.

The typical PE platform strategy is to generate value via a combination of strategic management, operational improvements, and expansion of the businesses via inorganic growth like add-on acquisitions. The platform investment thesis typically defines a clear exit strategy from the outset designed to optimize the company’s valuation and prepare for a successful exit after the hold period.

Typical value creation strategies & tactics include:

- Securing operational efficiencies & cost saving opportunities (e.g., supply chain optimization, inventory management, headcount reductions, facility rationalization etc.)

- Add-on acquisitions to achieve synergies and expanding the company’s scale and scope.

- Identifying new revenue streams and enhancing customer acquisition and retention efforts to drive top line growth.

- Investing in product development and innovation to create new products or enhance existing ones to better meet customer demand.

An earlier article outlined how to optimize the master integration plan to ensure the POR (plan of record) delivers the deal thesis. http://ow.ly/qTA450KaQ1I

This article goes into more depth on the value realization challenges that manifest during integration activities, along with the most common execution bottlenecks that delay value realization and steps to address them.

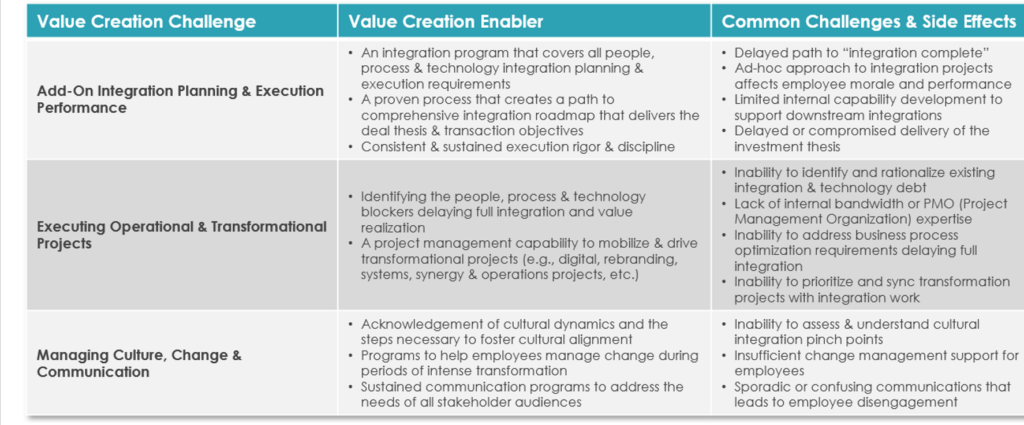

The table below summarizes 3 common value creation challenges:

- 1. Add-on planning & execution performance

- 2. Executing operational & transformational projects

- 3. Managing culture, change, and communications

For each of these 3 areas, we have outlined enablers (things that help capture value) and challenges/side effects (things that delay and/or erode value creation)

Add-on planning & execution performance

Most of our PE clients have inorganic growth plans for their platforms during their hold period, so add-on integration planning & execution performance is critical.

Typical value creation enablers include:

- An integration program that covers all people, process & technology integration planning & execution requirements

- A proven process that creates a path to comprehensive integration roadmap that delivers the deal thesis & transaction objectives.

- Consistent & sustained execution rigor & discipline

Common Challenges & Side Effects:

- Delayed path to “integration complete”

- Ad-hoc approach to integration projects affects employee morale and performance.

- Limited internal capability development to support downstream integrations.

- Delayed or compromised delivery of the investment thesis

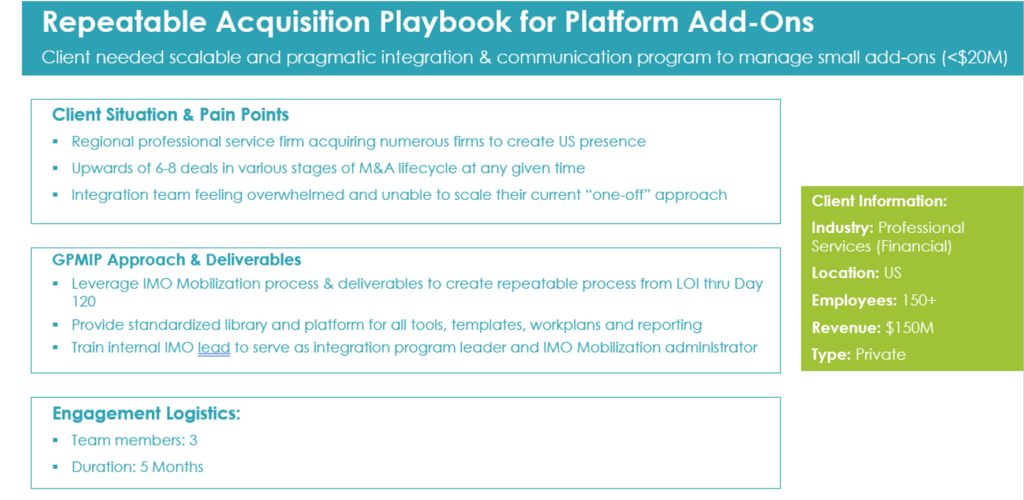

GPMIP client case study: Add-on planning & execution performance

Executing operational & transformational projects

Most all platform value creation strategies include a smattering of value creation projects covering all facets of people, process & technology that led to operational improvements. Many companies struggle with the planning and execution rigor necessary for transformational projects. Identifying the project is sometimes the easy part…mobilizing the project management expertise and resources to capture the value during the integration period is the key to success here.

Typical value creation enablers include:

- Identifying the people, process & technology blockers delaying full integration and value realization

- A project management capability to mobilize & drive transformational projects (e.g., digital, rebranding, systems, synergy & operations projects, etc.)

Common Challenges & Side Effects:

- Inability to identify and rationalize existing integration & technology debt.

- Lack of internal bandwidth or PMO (Project Management Organization) expertise

- Inability to address business process optimization requirements delaying full integration.

- Inability to prioritize and sync transformation projects with integration work.

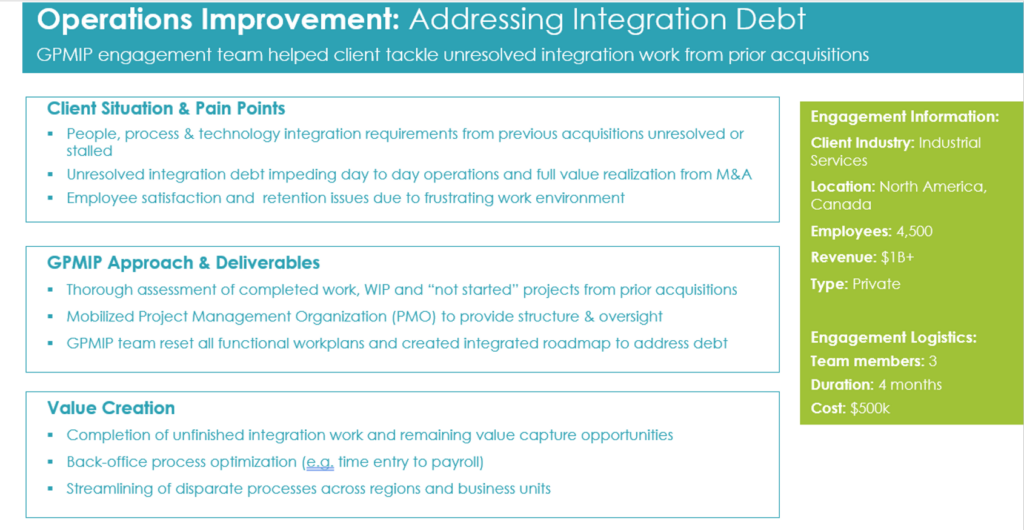

GPMIP client case study: Executing operational & transformational projects

Managing Culture, Change and Communications

Considered by some to be the “softer” side of M&A, culture, change and communications is anything but. Neglecting the realities of proactive cultural integration, the change management rigor required to facilitate transformation projects, and the communication programs required to mesh all this together are essential building blocks of add-on integration success.

Typical value creation enablers include:

- Acknowledgement of cultural dynamics and the steps necessary to foster cultural alignment.

- Programs to help employees manage change during periods of intense transformation.

- Sustained communication programs to address the needs of all stakeholder audiences.

Common Challenges & Side Effects:

- Inability to assess & understand cultural integration pinch points.

- Insufficient change management support for employees

- Sporadic or confusing communications that lead to employee disengagement.

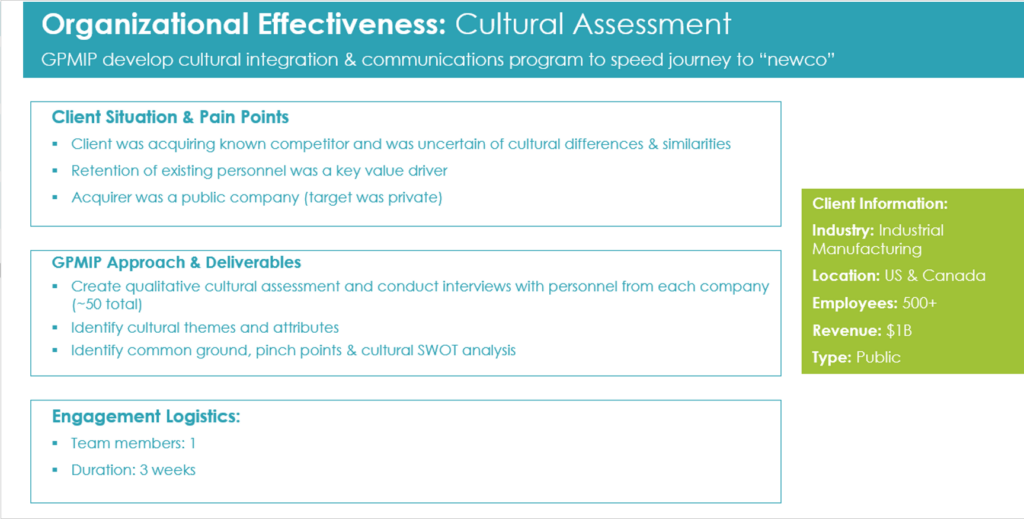

GPMIP Client Case Study: Cultural Assessments

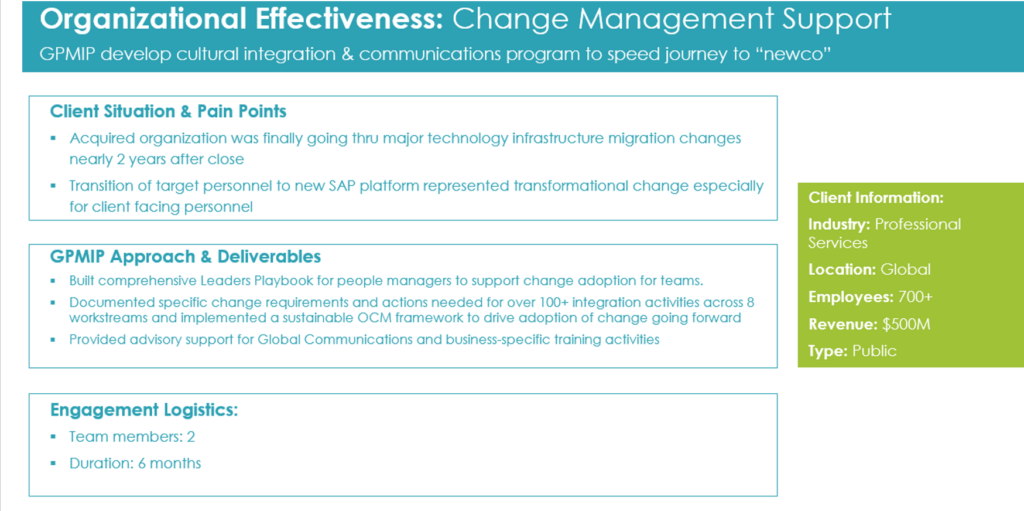

GPMIP Case Study: Change Management Support

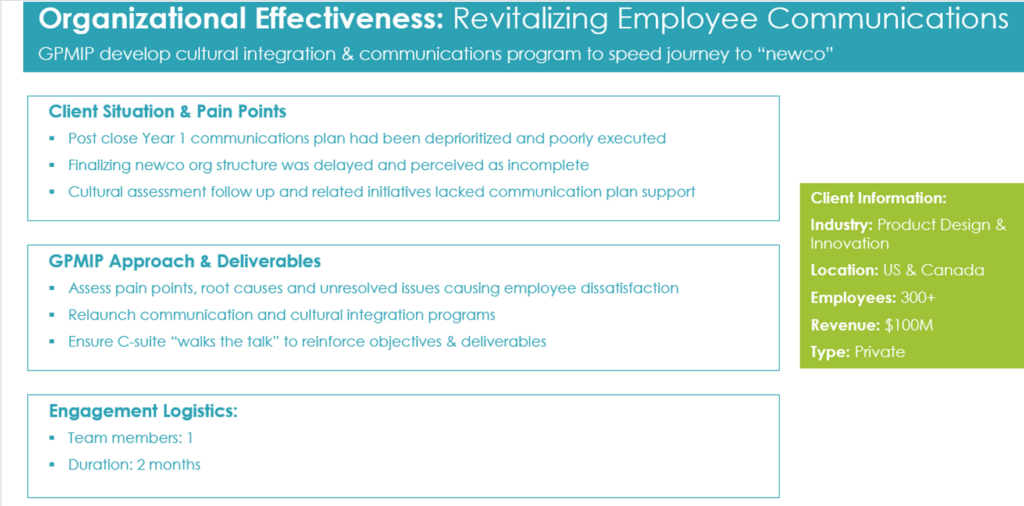

GPMIP Case Study: Employee Communications

Summary:

The key to realization success is being able to identify and scope specific value driver initiatives and then ensure that the planning & execution approach addresses the most common blockers and issues.

As with all integration-related activities, starting early is critical and connecting everything via a comprehensive integration roadmap by Day 100 will ensure the work is prioritized in a logical fashion.

For more information visit https://gpmip.com/about-us/americas/