Value Creation in M&A: Successful Delivery of the Deal Thesis

Value Creation in M&A: Successful Delivery of the Deal Thesis

By Global PMI Partners

Objectives of Article:

- To help readers understand the difference between a transaction’s investment rationale (deal thesis) and integration objectives

- To share best practices for converting integration objectives into actionable integration plans

- To share tips on how to optimize the master integration plan to ensure the POR (plan of record) delivers the deal thesis

- Share lessons learned and other related best practices to help avoid common pitfalls and ensure a successful integration

Any significant M&A transaction kicks out a lot of information via the diligence process and via the underlying corporate growth strategy. There are formal strategy presentations, confidential investment memorandums, and many customized methods for justifying the rationale for a target acquisition that inform the M&A process.

Firms like Global PMI Partners are tasked with ensuring the post-close integration of the acquired company delivers the deal thesis. One of the initial and most important steps in that process is to separate transaction rationale from integration objectives….so what’s the difference?

- Transaction rationale (often called deal thesis) is the underlying business case for why buying a company makes strategic sense and aligns with an organization’s inorganic M&A growth strategy. It may relate to things like geographic expansion, adding scale, adding additional capabilities, absorbing a competitor, etc.

- Integration objectives are specific and measurable initiatives that need to be completed across finance, IT, marketing, operation, sales, etc. during the integration phase to deliver the deal thesis for a specific acquisition

Integration leaders must separate specific integration objectives from the overall transaction rationale to help crystallize integration direction to inform downstream planning efforts.

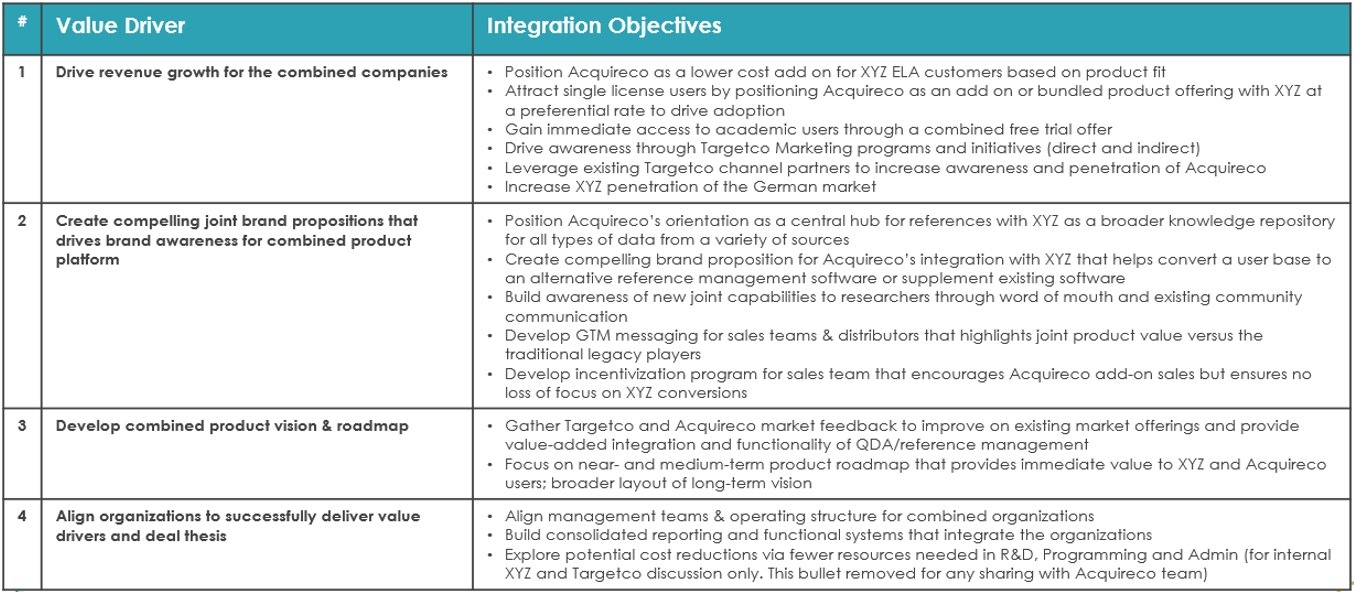

We use a process called Value Drivers & Objectives (VDOs) to help solidify integration planning direction. This document is shared with all IMO (Integration Management Office) functional leads at the beginning of the integration planning process.

Objective of this Step:

- Synthesize various transaction documents into a single brief for integration planning purposes

- Drive consensus and agreement on planning priorities at the start of the engagement

- Inform key message development that is the foundation of communication planning deliverables

- Provide a document that can be leveraged to explain transaction rationale to IMO personnel

Definition of Value Drivers:

- Key strategic levers that underpin the deal thesis

- Explains the “why”

Definition of Integration Objectives:

- Program and/or functional level integration objectives that need to manifest in the functional integration workplans

- Details the “what” in terms of integration priorities

See example VDO document below

VDO Process Lessons Learned:

- Executive alignment around VDOs is critical and must be completed on the front end before integration teams are engaged

- Lack of clarity and specifics in the VDO document will result in incomplete or insufficient functional workplans

- Target input into the VDOs is recommended but in some cases may be difficult when integration objectives involve significant changes like facility closures, layoffs, etc.

Turning Integration Objectives into Actionable Workplans:

Next, the Values Drivers & Objectives (VDOs) must be converted into actional workplans for each functional area (e.g., IT, HR, Sales & Marketing, Operations) to ensure the required work is getting broken down into more detailed workstreams and initiatives.

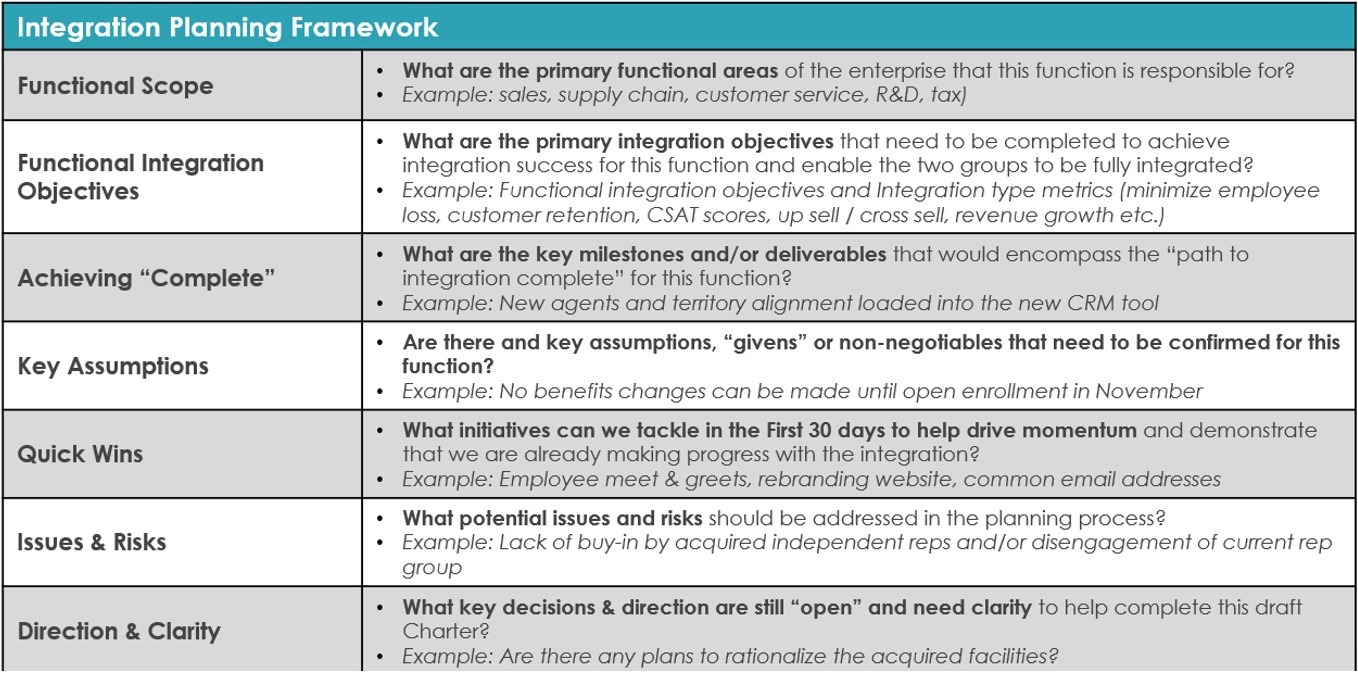

The most effective way to do this is to create a charter for each function. The charter template GPMIP created scopes each functional area as follows:

Plan Framework:

- Enables each team to outline the strategic framework of their workplan at a high level

- Translates the value drivers and enterprise integration objectives into more specific functional requirements

- Provides an opportunity for team leads to surface issues, risks, and areas where they need more direction

- An example of the Plan Framework template is included below

Workstreams & Initiatives:

The Functional integration objectives should then be broken out into a second template that:

- Organizes the functional plan into key workstreams that will represent the major “buckets” of work that will require expansion and development in the Smartsheet workplans

- Specifies what initiatives need to be completed by on Day 1 (Day 1 Mandatories), so the IMO can begin status tracking to ensure readiness by the target close date

- Serves as an outline of each functional workplan to allow for review at the Steerco and IMO level to ensure all required integration work is scoped and included in the master integration plan

Workplans, Roadmaps & Execution:

- Next comes the fairly straightforward process of developing detailed workplans with supporting task level detail like responsibility, status, timelines, dependencies, etc., which is typically accomplished in a project management tool like Smartsheet.

- Execution status monitoring should be accomplished via the weekly IMO process (see links to other articles about IMO best practices)

Chartering & Workplan Process Lessons Learned:

- A draft charter review session should be scheduled before locking down charters and proceeding to workplan development. The Worksession provides an opportunity for each team to share charters and confirm any gaps or overlap areas in the integration scope.

- It also is a chance for senior management to see the integration work at an “executive summary” level and share any concerns or provide additional clarity & input

- The Worksession also provides leads with an opportunity to raise issues, risks, and confirm areas where additional information or decisions are needed to inform integration workplan development

- Last, poorly developed charters result in incomplete workplans that fail to deliver on specific integration objectives. Time spent ensuring charters are robust will save time in the end.

Plan of Record Optimization:

- Typically, around Day 90 (close plus 90 days) GPMIP will conduct a plan optimization exercise. The purpose of the exercise is to ensure that the original value drivers and integration objectives have manifested in the master integration workplan.

- The reason this is a good exercise to do at Day 90 is that the functional planning process can get “myopic”, and as leads can get mired in detail is it often easy to lose sight of the mission critical objectives

- A comprehensive audit of the integration workplans is recommended at this stage to ensure all integration objectives are properly developed and articulated in and/or among the functional workplans

- This is also an opportune time to identify any areas for plan enhancements required in each plan prior to locking down the plan of record

Summary:

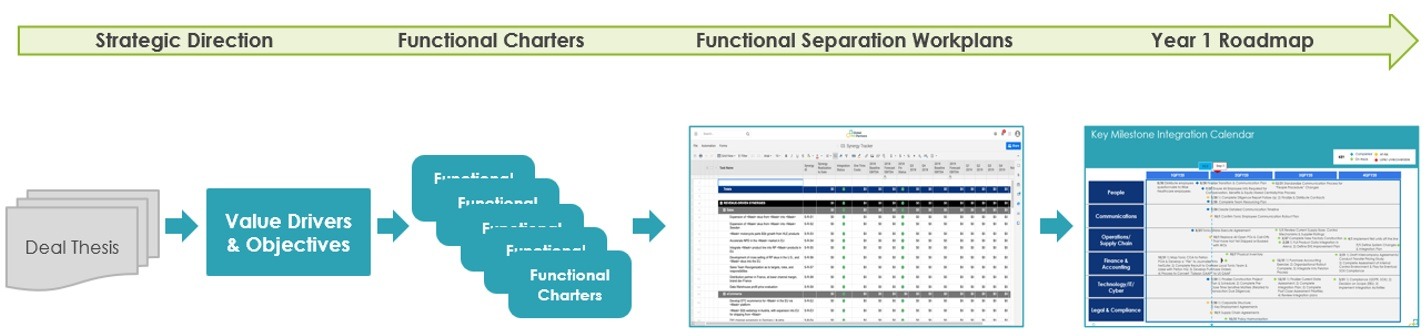

- The graphic below summarizes the process we just outlined which typically takes 30-60 days to complete.

- The process should be initiated pre-close, and it is always best to proceed as quickly as you can so you can accelerate the integration process and value delivery.

| Scott Whitaker | |

| Partner US |

For more information visit https://gpmip.com/

About Global PMI Partners

When Global PMI Partners started in 2009, our mission was to help our clients simplify the complex task of M&A, specifically by improving their integration planning and execution.

Since then, we have helped hundreds of clients from nearly every sector plan and execute integrations, carve-outs, business transformations and create playbooks to support ongoing acquisition activity.