Why M&A Will Remain a 50% Bet – and How to Avoid That

By GPMIP Partner, Gilles Ourvoie

My first M&A project was in 1987 (the pre-deal strategy of the acquisition of Carnaud by MetalBox). Since then, I have been reading hundreds of articles on M&A and PMI, and have worked on tens of projects. And every time, there is this standard question about how to limit the risks of not delivering the initial goals, and about M&A being a very risky business journey, and eventually about checklists or templates to reduce the risk…

Our viewpoint is that, despite the sky-rocketing increase of management knowledge and academic research, M&A operations will remain a risky bet. This viewpoint is based on 13 different elements:

1) Every deal is highly context-based and emotionally driven. The conditions in which a transaction is analysed and executed depends very much on the context. The acquirer has a culture, a history, procédures, success and war stories, fears, ambition,… The same thing for the target. How will they emotionnaly embark on a common journey, how will this result in a lasting success cannot be easily factored into…

2) The variability of the technical issues at stake is maximum (HR, IT, Marketing & Sales, Operations,…). This means that M&A projects are not simple projects focusing on 1 single issue. Interdependencies are of the highest importance. The management of these interdependencies (planning, decision-making, trade-offs, communication between stakeholders,…) is not what you would expect in normal business conditions.The only equivalents I can see in terms of management stress are start-up situations or restructuring crisis.

3) The economic landscape is complex by nature. It covers regulations, competition, service offerings, innovation pace, micro and macro financial patterns… This changes in a permanent way due to technology, media, information, political decisions,….

4) High speed of obsolescence. Based only on those 3 elements, we can easily understand that the obsolescence of the accumulated M&A knowledge is quick and possibly accelerating. This limits the long-term efficiency of mechanical approaches of business and management. Checlists and templates are in this overall context much the same as a set of grammar rules in creating a poem for a moving audience of foreign visitors…

5) These different elements should lead to a high level of caution in launching M&A transactions. If everyone knows that only 50% of the deals are a success, then why do leading business executives, bankers, lawyers, strategy advisors, etc… do all participate to such a risky bet ? Beyond the potential divergences in terms of business interest, is there something that plays in favor of accepting this high level of risk in the decision-making process?

6) To understand the stable high level of failure in M&A deals, we have to focus more on the perception of risk. Investment strategies do not reflect competencies per se, but the risk perception of a deal based on the accumulated M&A/PMI knowledge and experience of the different stakeholders involved on the buying side.

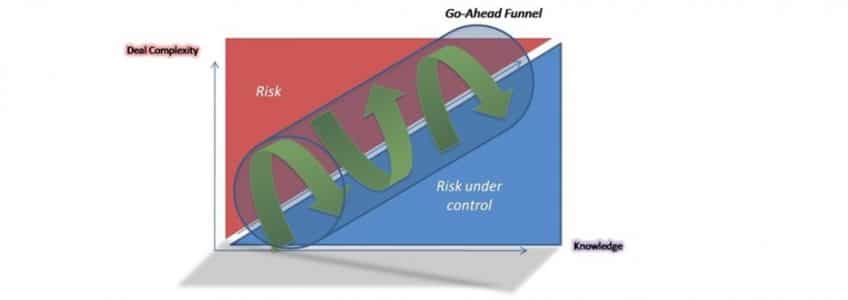

7) Risk perception is based on knowledge, though it cannot be limited to knowledge. Because of insufficient information, board members cannot develop a comprehensive view of all the risks at stake. The decision-making process, based on the accumulated M&A experience of the different stakeholders involved, is hence a proxy in terms of risk assesment : it may have an over or an under-estimate of the actual risks(figure above)

8) Globally, observed PMI low success rates indicate that there is a significant and stable over-estimate of skills and capacities to manage actual (and moving) deal complexity. The percentage of executives under-estimating risk and engaging transactions on that basis seem to be quite stable over time (c. 50-70%). This stable pattern may reflect the strong confidence of executives on management methods and techniques and be correlated to personal psychological traits in terms of risk perception.

9) Transactions are built based on the risk perception, not the other way round. In terms of corporate strategy, the more companies get experienced in M&A transactions and PMI management, the more they may accept to design and launch complex deals to improve their competitive position.

10) Building a candid and constraintful Corporate Strategy process is a way to secure the best use of knowledge. The accumulation of knowledge does not translate into risk reduction unless target screening is based on fixed and PMI risk-related filtering criteria (eg. target size, number of sites, expected synergy levels as a percentage of investments…). This is typically what has been done in serial acquisitory groups, and it shows on high success rates. When deal logic is more based on a case-per-case approach, accumulation of knowledge may be used in order to stand for more complex and bigger deals. Historically, this is why the size of deals increases with accumulated experience.

11) But you will need to assess your M&A knowledge and execution experience first. If you want to discuss external growth, how to make sure you can deliver? Is your IT ready, your HR organisation mobilised enough, are your reporting mechanisms and budgetting data reliable enough, is your governance model able to adapt? M&A improved knowledge does not automatically generate improved profits. This depends only on the corporate strategy adjustment to knowledge. Knowledge is effective when its implementation horizon is stable. The productivity gains of accumulated knowledge and experience is destroyed by an increased complexity of the situation. How could you gain on costs and reduce the Ford car pricing if you wanted to sell customized cars?

12) Corporate knowledge and culture can generate however strong biases in the perception of self. There is a political and sociological image of that – look at what empires have experimented over centuries: in most cases their progress in administrative and knowledge control has led to extensions first, then to increasing difficulties. The most intriguing issue is about their will to continue their expansion process up to their limits This is where knowledge becomes arrogance and self-esteem collective faith. International firms have the size of Athens in the century of Pericles. The major global firms do have very similar cultural patterns with small nations – a strong corporate identity is not always a success factor – look at GM, look at Wall Street.

13) And do not forget that M&A is a competition between firms – a competition based on intelligence and savoir-faire. Statistically speaking, the 50% failure rate in M&A delivery should not only be viewed as a simple outcome of a stockpile of corporate knowledge and experience. It reflects essentially the fact that the risk perception in some firms is below the actual degree of complexity of the deals generated by the competition between firms. Executives get into the M&A competition with a certain view of their past experience, and of their capacity to deal with future difficulties. In c.50% of the cases, this view should have been challenged a bit more, not by looking at the accumulated knowledge on M&A and PMI, but by looking more at the future execution challenges of that particular deal.

Conclusion. Is there a way out of this global logic of stable 50% failure rate? Macro speaking, no – the higher the knowledge, the bigger the risks taken because of competition and biased self-assessment, until the macro-level of 50% failure rate is reached again and again. But the good thing about all this is that in reality this macro stat has a very small interest for a particular company and executive. The right issue to tackle should be – how to make sure that my transactions will remain in my organisational zone of control and hence will not fail? Our experience suggest there are structured alternatives to M&A failure. But there is no silver bullet.

What has been your experience with M&A? Comment and “Like” this post on LinkedIn by clicking here.

Interested in learning more about Global PMI Partners? Join us, join our network.