2023 Year in Review

By GPMIP

2023 M&A Activity

The M&A landscape in 2023 has been subdued compared to previous years, witnessing a decline in deal activity across all regions on both a year-on-year and quarter-on-quarter basis. This reflects a prevailing corporate caution towards M&A endeavours, with dealmakers contending with geopolitical tensions, inflation, rising interest rates, and heightened regulatory scrutiny amidst a backdrop of general economic uncertainty across most regions.

Nevertheless, deals persisted. While the total value of deals experienced a 23% decline, reaching the lowest level since 2013, the number of deals dropped by 16%, underscoring a shift towards a focus on smaller deals. Noteworthy was the standout performance of the tech sector, which, despite a downturn from previous years, maintained momentum, fuelled by market excitement surrounding artificial intelligence (AI) and other emerging technologies. In a Q4 twist, the oil and gas sector surpassed tech in value, marking the first time in recent years, driven in part by two significant blockbuster transactions.

Q4 showcased signs of recovery in the M&A market. Big-ticket deals ($2BN+) reached their highest levels since Q2 2022, with five of the year’s 10 largest global deals announced. The prospect of additional clarity, if not full resolution, regarding some of the challenges faced in 2023 may pave the way for a resurgence in M&A in 2024. Companies are anticipated to focus on implementing growth, earnings, and valuation strategies in the coming year.

Global activity through December 15 reached $2.9 trillion in value, down 23% year-over-year.

Regional and Sectoral Deal Dynamics and Activity

EMEA: EMEA witnessed $676 billion deal activity, reflecting a 35% decline from the previous year. Notably, U.S. companies took the lead in inbound acquisitions, boasting deals valued at $89 billion. Mirroring the global M&A trend, Q4 saw a significant surge in EMEA deals, marking a notable 13% increase compared to Q3.

Tech Sector: Technology continued to be a favoured sector, contributing to 27% of the overall deal value. Our 2023 M&A Survey revealed continued consolidation in software and IT Services, plus a strong inclination toward cybersecurity as a promising subsector for deals over the next 12 months, with the AI sector also emerging as a robust dealmaking opportunity.

North America: North America’s deal landscape totalled $1.46 trillion, experiencing a 12% decline from 2022. The latter half of the year, particularly September and October, witnessed promising activity, highlighted by several megadeals. Cisco’s acquisition of Splunk, Exxon’s agreement with Pioneer, and Chevron’s agreement with Hess were among the notable transactions. The UK’s Arm’s $5 billion debut on Nasdaq in September, the largest IPO since 2021, buoyed U.S. capital markets.

Asia-Pacific: Asia-Pacific dealt with a total of $708.2 billion in deals, marking a 26% year-over-year decline. Cross-border activity between China and the U.S. experienced continued challenges, while Japan stood out with a remarkable 34% increase in the number of deals compared to 2022. The healthcare sector in APAC reached its highest-ever value level, and auto industry M&A witnessed an 80% year-over-year increase.

Healthcare Sector: Healthcare maintained its robust performance, securing its position as the third-highest sector by volume in North America. Major M&A transactions, including Pfizer’s $43 billion takeover of Seagen, underscored the sector’s significance. Healthcare M&A in APAC achieved its highest-ever value level, exemplified by Daiichi Sankyo’s $22 billion deal with Merck.

Private Equity Landscape: In the realm of private equity, sponsors took a cautious stance, with global deals dropping by 33% in volume and 41% in value year-over-year. Facing challenges like rising interest rates and tightening credit markets, sponsors adapted their dealmaking strategies, incorporating more equity, additional seller rollovers, and private credit financing.

Emerging Themes:

Environmental, Social, and Corporate Governance (ESG): emerged as a prominent driver of M&A activity in 2023, followed by themes like emerging economies, artificial intelligence (AI), supply chain disruption, and big data. A noticeable trend involved the rising number of technology-related acquisitions, with companies aiming to enhance digital capabilities, expand customer bases, and access innovative technologies.

Cross-Border Expansion: Companies displayed an increasing inclination to explore cross-border acquisition opportunities, seeking access to new customer bases, diverse talent pools, and global markets.

Post-Merger Integration Focus: A noteworthy shift was observed in placing greater emphasis on post-merger integration, acknowledging the necessity to efficiently merge operations, cultures, and technologies to unlock the full potential of acquisitions.

2023 Global PMI Partners Annual Success Survey

We were pleased to present our 2023 Annual M&A Success Survey in Q4, sponsored by Global PMI Partners, Oxford University Said Business School, and Sterling Technology. This survey provided insights into the key elements that are essential for acquirers to achieve their deal rationales, along with guidance on how to respond to new M&A challenges.

2023 Survey results: more focus on achieving M&A success vs. just getting deals done:

- This year’s top deal rationale was enhancing value, replacing last year’s which was focused on growth.

- Selling a non-core business remains the most common driver of carve-outs.

- Almost 20% of respondents ’do not know’ if their last transaction was successful.

- 72% of acquirers who validate, manage, and track their synergies have a high deal success score.

- 61% of respondents leveraged or hired internal resources or had existing expertise in place.

- Single-country deals decreased by 13% from 2022.

- Respondents marked planning, execution, and implementation as dominant areas requiring improvement for future M&A.

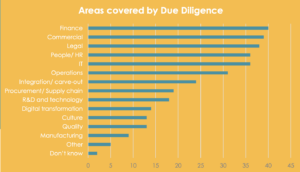

- Compared to 2022, there was a decrease in culture and legal due diligence.

- It was found that nearly 70% of respondents used a playbook for both M&A integrations and carve-outs.

Related insights: considerations for M&A success, regional differences, and technology:

- Companies investing in internal integration and carve-out skills development expect better results for M&A activities.

- The focus is on gaining market share and geographic expansion also figured prominently. For smaller players, acquiring skills and expertise comes first.

- By far the most common technology solution used during M&A is a virtual data room (VDR).

In 2024, dealmakers generally foresee a continuation of the positive trend observed in Q4, anticipating improvements in the M&A environment. Although inflation has declined, it hasn’t yet reached the Fed’s target. Interest rates may have stabilised and be on a downward trajectory. The availability of private credit has expanded for a broader range of deals, and traditional credit markets are showing signs of recovery. Despite lingering volatility, equity markets have rebounded, reaching new highs at end of 2023.

However, uncertainties persist amid economic instability, geopolitical tensions, heightened regulatory scrutiny, and upcoming elections in the U.S. and other regions, such as the UK.

Forward-thinking companies are poised to explore strategies for growth, such as expanding product lines, and enhancing performance through strategic divestitures to address challenges posed by technological disruptions and other factors. The consideration of optimal approaches to raising essential capital and ensuring liquidity will be paramount. Adaptability, innovation, and agility will play crucial roles in navigating this dynamic landscape.

Global PMI Partners would like to thank all our clients across all industry sectors who we worked with in 2023 on many successful deals, including assignments covering synergy & cost assessment, operational due diligence, integration planning & execution, carve-out & separation management, and operational transformation. See our Case Studies in each Industry Sector for more information on recent activity. We look forward to further growth and enhanced activity in 2024.