Delivering the food on the table – Acquisition Integration in Agriculture industry

By Mikael Kruhsberg, Nordic Partner and Dirk Hanssen, Senior Executive Advisor at Global PMI Partners

In this article we outline four specific issues that are important when doing an acquisition integration in the agriculture industry. They are:

- Higher information technology (IT) integration risks, related to legacy systems as compared to other industries

- Importance of intellectual property (IP) rights, as it relates to the rights of the producer

- Sustainability and transparency and the inherent risk to brand equity

- National food security anxiety

Agriculture is arguably the most important industry of all, being responsible to feed a growing global population, produce renewable fuels and provide sustainable raw materials at a low cost. Its importance will not diminish as our global population grows.

Historically, the agricultural industry has been largely fragmented with focus on individual national markets. However, in the last couple decades, it has started to consolidate into larger, integrated companies. This change is driven by numerous forces, including global supply chains, advances in technology and intellectual property rights, all of which are fueling M&A activity.

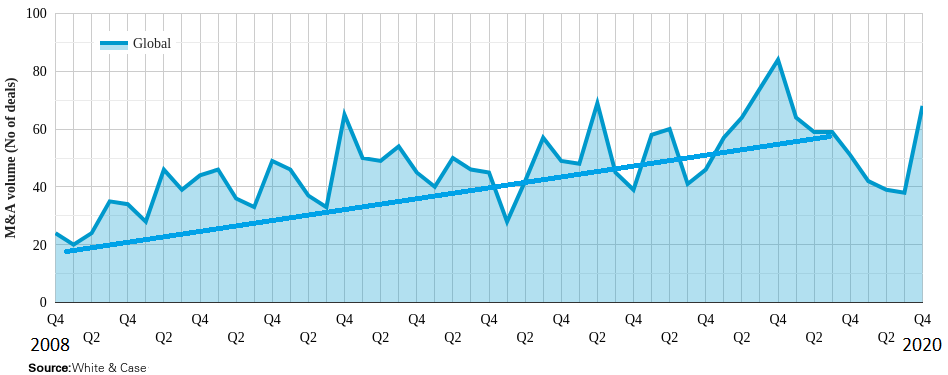

Agriculture Merger and Acquisitions activity from 2008 to 2020

As in any industry, integrating a company in the agribusiness will require razor–sharp focus on the underlying deal rationale, diligent project– and program management and attention to the people and cultural aspects of change while ensuring the delivery of the deal value.

Specifically, for the agriculture industry, there are several topics that are unique for the industry and require special attention in planning and executing an acquisition integration. In the following article we outline a handful of these and their implications for planning and executing an acquisition integration.

- High risks in IT integration

Price volatility is inherent in agribusiness, and the last couple of years of global political instability have not helped in the matter – nor has a number of low production years caused by local variations in climate. This obviously puts pressure on any value realization that is expected from an acquisition, and it also puts pressure on the planning and execution of the acquisition integration.

Due to this volatility and the fact that the value-add in the early steps of the production process are usually quite thin, companies typically have very tight control over cost, quantity and quality in every step of their supply chains. This control has, in general, been achieved through ERP systems with connections and integrations to bespoke systems such as production IT, quality management systems, trading systems, etc., all resulting in complex IT environments, often with mix of modern and out-of-date legacy systems and leading to high integration risks. The requirements on the IT- Due Diligence (DD) and how to translate these findings into a solid pre– and post–close integration plan are very high.

- Importance of data, patents and other intellectual properties

Data, whether being state-of-the art market intelligence delivered to the farmer or valuable information captured from satellite imagery, drones or farming equipment, has the potential to re-shape the agribusiness. With traditional IP development, e.g. the number of patents in crop protection or seed treatments, significantly slowing down, Big Data has become the key accelerator for innovation and hence a major driving force behind many M&A deals.

While the general acquisition integration project team is aware and accustomed to manage intellectual properties and patents, the requirements to ensure a continued flow of data and the ownership of that data contain some specific complexities in agribusiness. A farmer generating data with insights into his or her business through the use of, for example, a connected milking robot, a drone or a harvester with sensors, would typically have an agreement with the supplier of that piece of equipment outlining data ownership, its usage and the requirements on the farmer. Should that supplier be the target of an acquisition, it is not evident that this agreement is transferable and would usually require agreements with each and every farmer — a lengthy process that depends on the legal status of the farmer. It could even be governed by private consumer laws.

- The conscious consumer

There is no secret that sometimes we have very long and complex supply chains ending on the consumers’ dinner plates. Certifications, both national and on wider geographic areas such as the EU, provide the consumer with the transparency to review a product’s whole life cycle simply by scanning the products’ label in store. And, although it is today primarily a developed-word phenomenon, the growing concern about the diet and its impact on both the body and the environment is growing worldwide. Ensuring full environmental and social sustainability commitment is paramount. Even in a pressed-for-time acquisition integration project, there are very large brand equity values at stake.

- Increased national food security anxiety

The security requirements of being able to feed its own population is driving protectionism and it will often be a significant factor to consider in agribusiness M&A. There have been a number of deals vetoed by governments for this reason. In our experience, although the impact of public interest or foreign investment restrictions can greatly increase uncertainty for companies, it is possible to successfully navigate these issues by building them into deal planning from the outset. It can be helpful to engage with the authorities in all relevant geographies at an early stage, and it may be necessary to take a creative risk-based approach to build mitigation strategy at an early stage and integrate contingency plans into the intended deal structure.

Conclusion: The harsh reality of M&A in agriculture is the same as within any industry. There are more deals that fail to deliver the full potential of the deal rationale than those that do. Ensuring a well-prepared integration plan and efficient and professional execution will stack the odds in your favor.

| Mikael Kruhsberg | Dirk Hanssen |

| Nordic Partner GPMIP |

Senior Executive Advisor |

Mikael Kruhsberg is a Nordic Partner for Global PMI Partners, an M&A integration consulting firm that helps mid-market companies around the world by delivering exceptional consistency, speed, and customized execution on the complex operational, technical and cultural issues that are so critical to M&A success.